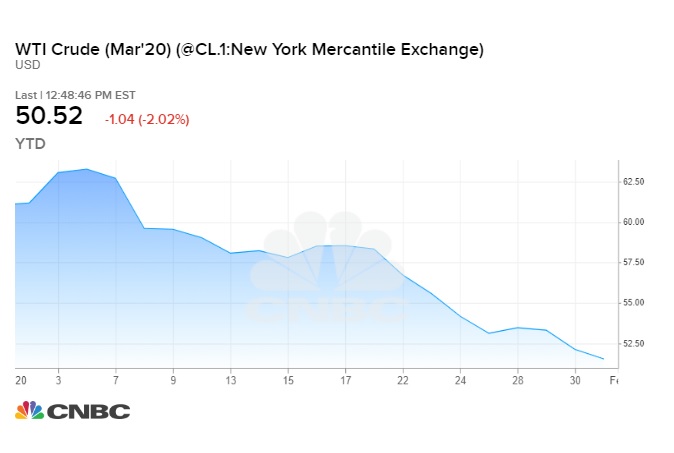

Oil falls to a more than 1-year low below $50 on fears the coronavirus will slow global growth

February 03, 2020 @ 22:01 +03:00

Oil fell to its lowest level in more than a year on Monday as the coronavirus outbreak and its potential impact on demand further hammered crude prices. “The oil market has been subject to many supply shocks over recent years, but an acute demand shock has not been felt since the 2008 financial crisis,” RBC’s Michael Tran said in a note to clients Monday, adding that the coronavirus has “roiled the oil market.”

U.S. West Texas Intermediate fell 2.2%, or $1.16 per barrel, to trade at $50.37. Earlier in the session, WTI fell more than 3% to $49.92, its lowest level since Jan. 2019. International benchmark Brent crude dropped 3.2%, or $1.85, to trade at $54.77. Earlier in the session, Brent fell to a session low of $54.67, its lowest level since Jan. 3, 2019.

China is the world’s largest oil importer and the second-largest oil consumer, so a demand slowdown could have a big impact on prices. WTI and Brent are trading in bear-market territory of at least 20% price declines from recent highs and are coming off four straight weeks of losses. The energy alliance’s Joint Technical Committee, a nonministerial sub group that reviews the oil market, will reportedly hold meetings Tuesday and Wednesday in Vienna to discuss options to mitigate the impact from the coronavirus outbreak. The action could include additional production cuts. A full OPEC meeting could take place next week.

Oil falls to a more than 1-year low below $50 on fears the coronavirus will slow global growth, CNBC, Feb 3