NFP commentary: Strong job growth vs weak wages

May 03, 2019 @ 16:55 +03:00

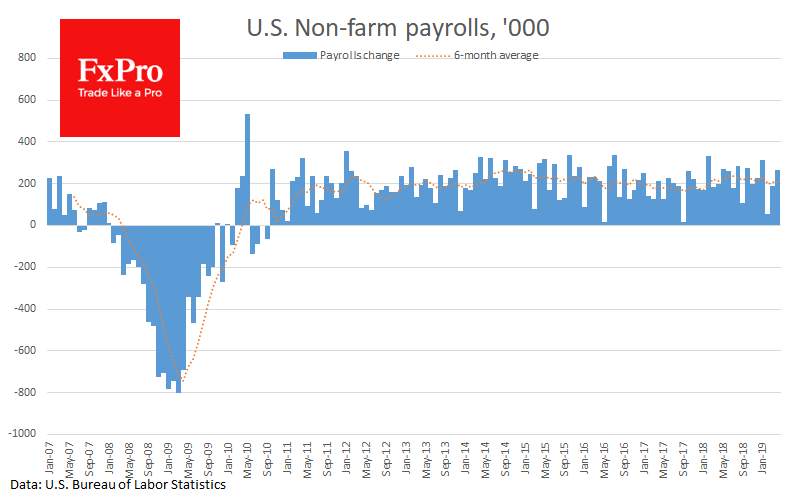

The increase in the number of employed in the U.S. proved to be significantly stronger than expected, amounting to 263K. Moreover, the previous two months data was revised upward. The unemployment rate collapsed to 3.6% (new 50-years lows), but the dollar failed to add-up on this statistic to develop its growth.

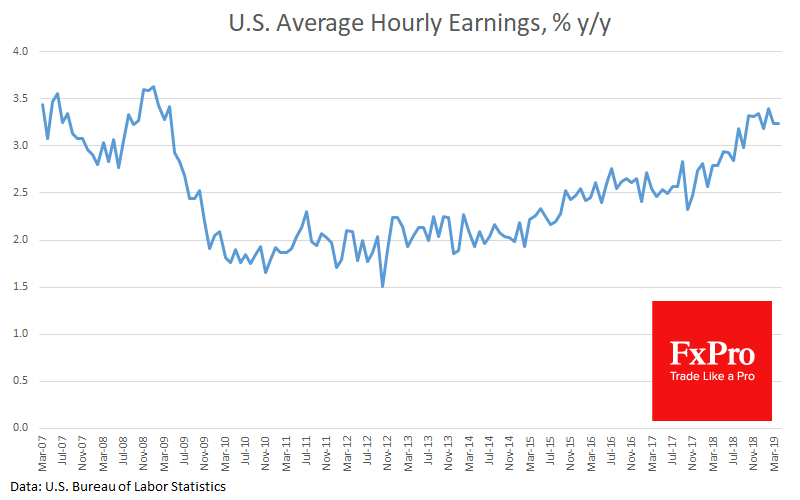

EURUSD got support after the initial drop to 1.1130 area, as market participants react to weak wages growth. Average hourly wage grew by 3.2% y/y (vs expected 3.3% y/y). This is another sign that inflationary pressure is not gaining momentum, that contradicts the Fed’s main message earlier this week that the inflation slowdown is temporary.

Moreover, the decline in the unemployment rate is caused by a drop in the Participation rate from 63.0% to 62.8% as more people drop from the labour force. This is also a bad sign for the economy, arguing against the fact that the Fed will soon have to contend with the overheating of the economy.

The FxPro Analyst Team