Nasdaq100 and Nvidia: shakeout, but no reversal yet

June 25, 2024 @ 13:16 +03:00

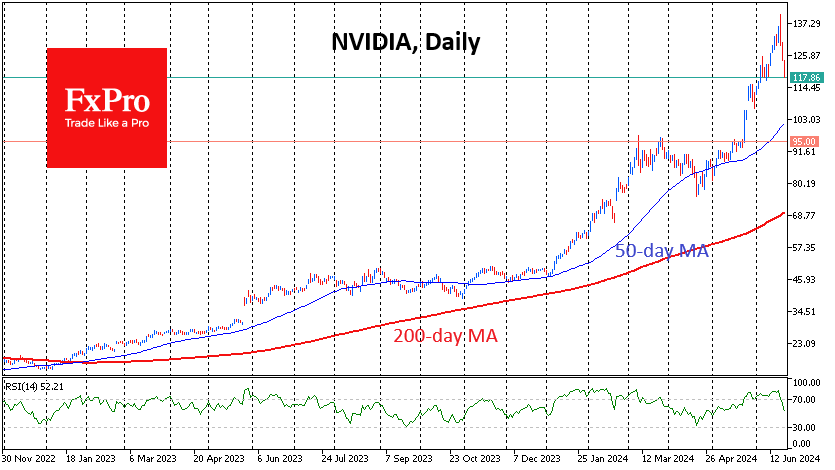

Shares of Nvidia, the world’s most traded, most popular, and most valuable company, have been under corrective pressure for a while. From last Thursday’s peak at $140.48, the price has lost 16% to $117.86 in just three trading days.

Investors are taking abundant profits in one of their favourite securities, which has seen a three-fold increase in price since the beginning of 2024 and a ten-fold increase since the beginning of 2023. The amplitude of the company’s growth and capitalisation is so significant that it influences the direction of the Nasdaq100 index and the entire US market.

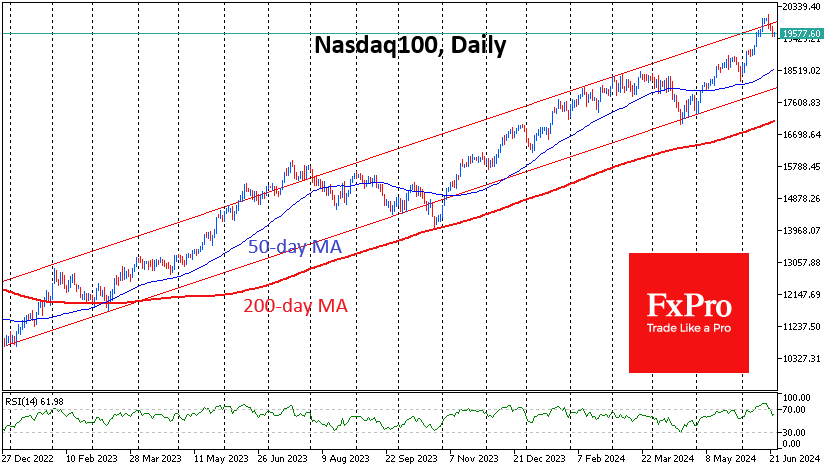

Nvidia’s 6.7% drop on Monday provided the worst day for the Nasdaq100 since April. For now, we’re seeing more signs of a quarterly portfolio shakeout but not a global downside reversal.

The heavy selling in the Nasdaq100 index has come with the index touching territory above 20,000, taking 3% away from it already. However, the old-fashioned Dow Jones index has been adding all this time, aiming for a third attempt to storm 40,000, its psychologically appealing mark. This looks like an attempt to change the buying focus but not a global exit from risk.

Talk of a global reversal to a bear market is too premature and has little validity. For now, a pullback to the lower boundary of the upside range, which has been in place since late 2022, looks like a working scenario. Now, it passes through 18,000, but in a month, it will approach the area of 18,400-18,500. This is where the highs are centred, and growth temporarily stalled in March. In addition, the 50-day moving average will be close by.

In turn, Nvidia, the market’s Pied Piper, may roll back to the $95-100 area before it can find a new wave of demand. But in this case, we shouldn’t be surprised if sellers further weigh down the stock under pressure from competitors and overly inflated investor expectations at the start of the year.

Only a dip below this area would activate a scenario of a deeper dive to 17,000 or below.

The FxPro Analyst Team