Nasdaq 100, Dow are on the verge of a 20-40% drop from the peak

April 06, 2022 @ 17:42 +03:00

Stock market indices have reversed downwards as sustained dollar strength with tightening financial and trading conditions worldwide worsens the outlook for companies.

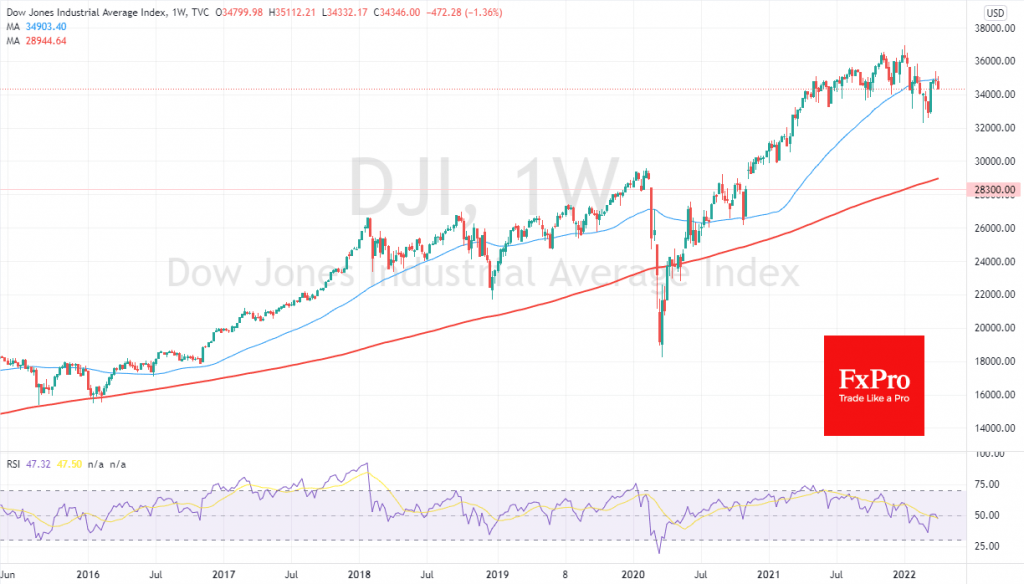

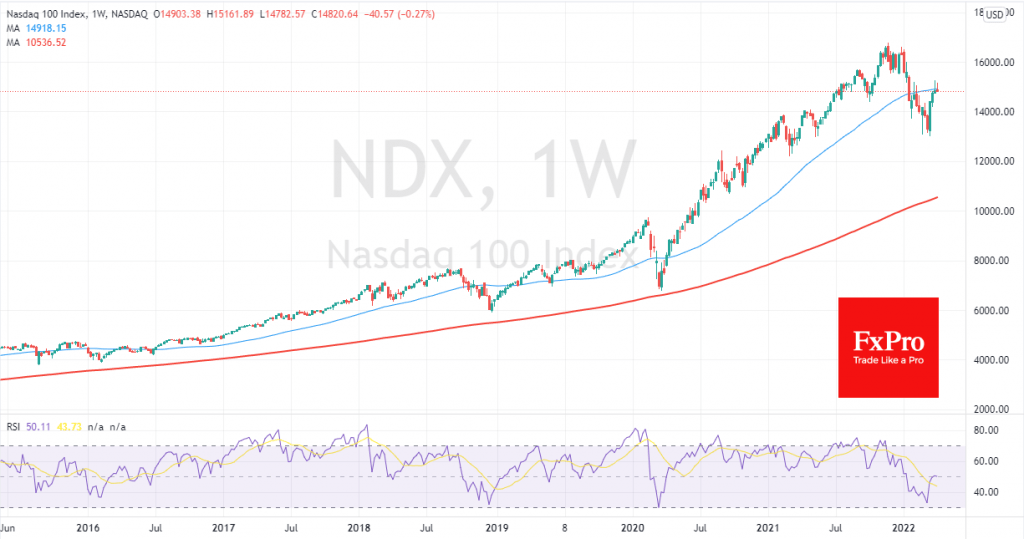

From the technical analysis perspective, the Dow Jones and Nasdaq100 fail to consolidate above their 200-day moving averages and major round levels – 35,000 and 15,000, respectively. Nasdaq100 futures have lost more than 4% since Tuesday, with the Dow Jones down 2%, which is a pretty sharp reversal and often heralds a substantial further decline.

The decline in stocks on war fears left hopes that the situation might soon be resolved. But in the case of stocks dropping due to Fed and other major central banks’ policy tightening, there is little hope of a reversal soon.

The last time the Fed raised its key rate by 50 points was in May 2000, and the Nasdaq had peaked two months earlier. It took more than two years for the index to rebound from the bottom, and it did not manage to consolidate higher until late 2016 finally.

If the Fed minutes coming out later today do not dissuade the market from a challenging scenario, in the current environment, a correction of the Nasdaq 100 could take the index into the 10,000 area from the peak of 16,600, which would be a 40% pullback from the peak.

In a pessimistic scenario, the Dow Jones opens the road to 28,300-29,000, corresponding to a 21-23% pullback from the historical highs.

Alternatively, the Fed might try to reassure the markets, as it did in February, that they are too far gone with their fears of Fed firmness. And the first step in that will be the FOMC minutes published today and subsequent comments from FOMC members.

The FxPro Analyst Team