Markets wait for Nonfarm Payrolls data

July 06, 2018 @ 09:52 +03:00

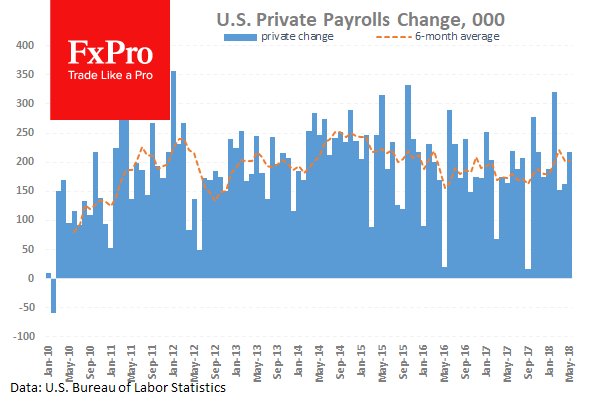

At 12:30 GMT, US Non-Farm Payrolls (Jun) is expected at 195K from a prior 223K. This measures the change in the number of employed people in June. The Unemployment Rate (May) is expected at 3.8% with a prior of 3.8%. Labour Force Participation Rate (Jun) is expected to be 62.7% against a prior reading of 62.7%.

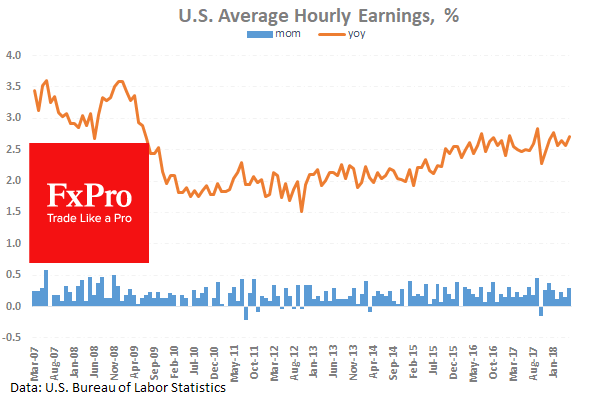

Average Hourly Earnings (Jun) is expected to be 0.3% (MoM) and 2.7% (YoY) against 0.3% (MoM) and 2.6% (YoY) previously. Average Weekly Hours (Jun) is expected to be 34.5 against a previous 34.5. This data can have a large impact on markets as the tight labour market has yet to show its impact with an increase in earnings. This would lead to an increase in inflation which markets have reacted negatively to recently. USD crosses and assets can experience extreme volatility around these data releases.

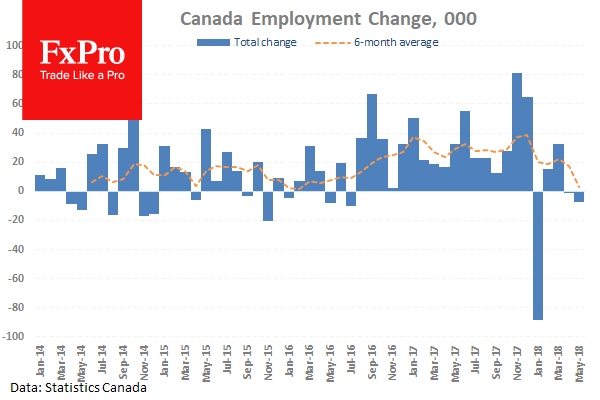

At 12:30 GMT, Canadian Unemployment Rate (Jun) is expected to be 5.8% against a previous 5.8%. Participation Rate (Jun) is expected to be 65.3% against 65.3% prior. Net Change in Employment (Jun) is expected to be 24.0K against a prior -7.5K. Unemployment had fallen to the lowest levels in ten years and is settled around 5.8. CAD pairs can see an increase in price movement from this data.

Canadian International Merchandise Trade (May) is expected to be $-2.05B against $-1.90B previously. This fell to match the low of November 2016 in May at $-4.10B but rebounded last month, and it is expected to come in weaker today.

At 14:00 GMT, Canadian Ivey Purchasing Managers Index s.a. (Jun) is expected to be 63.2 against a previous 62.5. Ivey Purchasing Managers Index (Jun) was 69.5 previously. The data dropped from the April reading last month which was the highest since 2011 at 71.5 and slipped under expectations. This data is showing robust growth, despite the fall as it is now at recent levels, continuing one of the longest positive runs with over 20 months above 50.0. CAD crosses can be moved by this data release.

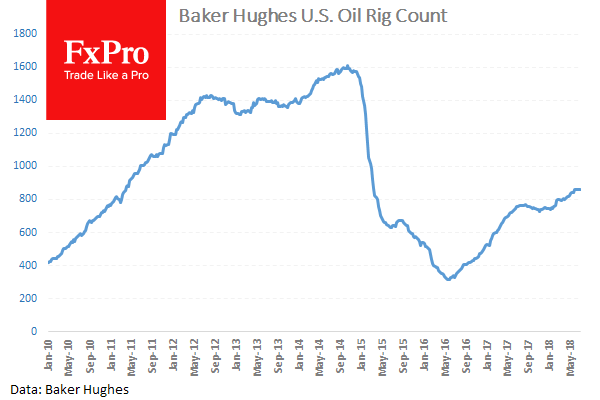

At 17:00 GMT, Baker Hughes US Oil Rig Counts is due to be released with a headline number from last week of 858 from 859 previously. Oil prices fell last yesterday after a build in inventories following 3 weeks of bigger than expected draws. WTI Oil can become volatile around this data release and will be in traders’ minds when trading resumes on Monday.