Markets are retreating from extremes, not daring to enter a new phase

November 13, 2020 @ 12:12 +03:00

The increasing number of global coronavirus infections is preventing markets from completely departing from current pandemic trends and entering a new phase.

For the equity market, this results in renewed pressure on company shares in affected sectors. In commodities and currencies, we see movement halting near the bounds of the recent months trading range and the first attempts to return deeper within it.

We pointed out previously that this week, key stock indices have lost their growth momentum near local highs. On Thursday, a similar performance was cemented for the currency market as pairs rolled back from local extremums without daring to break through trading ranges.

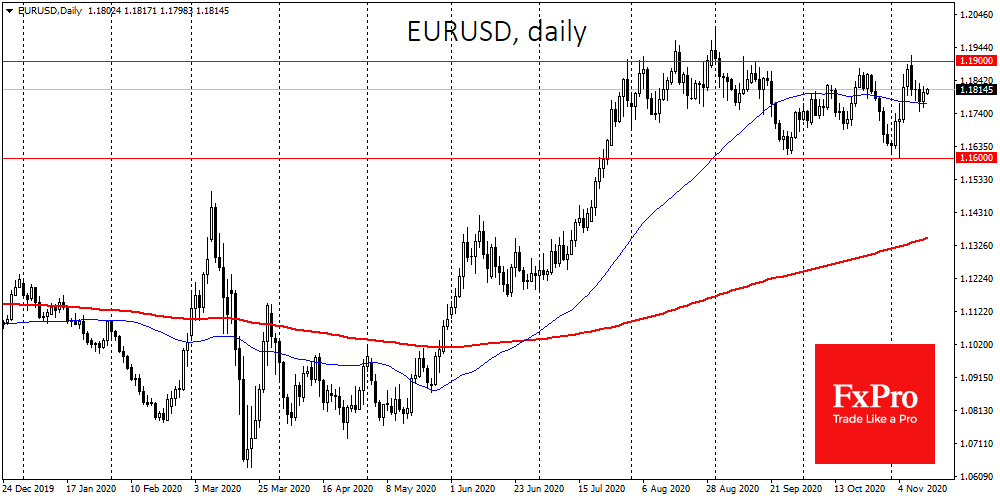

EURUSD this week made another unsuccessful attempt to climb solidly above 1.1900 and to repeat the test of the psychologically important level 1.2000. The pair quickly dropped to 1.1750 and then returned to 1.1800. The dynamics signalled that it was too early for markets to move to a new stage. EURUSD decreased to 1.1600 in the second half of September and during October, so we could now see a repeat of this move.

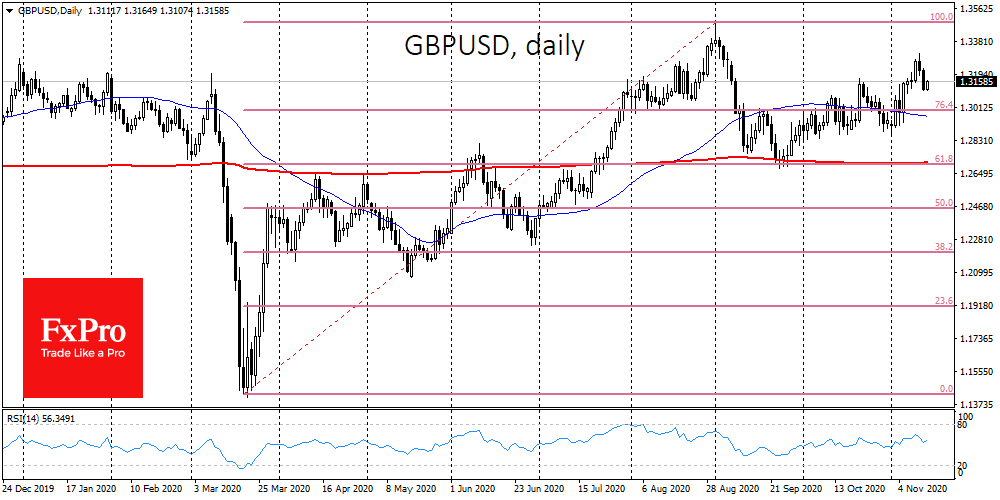

GBPUSD failed to grow above 1.3300, falling back to 1.3130 by Friday morning. For GBPUSD, the first line of support could be the area 1.29 (lows of early November), and a deeper correction could send the pair to 1.27. There is a support area in September, a 200-day average and a 61.8% Fibonacci correction line from the March-September rally.

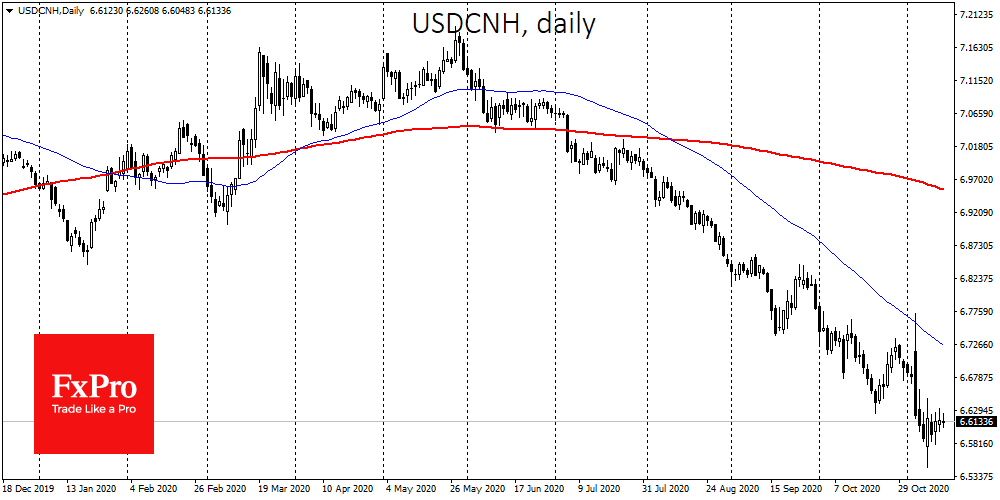

Outside Europe, AUDUSD declined after briefly touching levels above 0.73, potentially targeting a return to 0.7000. The USDCNH made a U-turn this week and became one of the early indicators of optimism soothing in the markets.

However, the yuan could also be negatively affected by the failure of Ant’s IPO, sending a signal of dissatisfaction from the authorities regarding the astronomical strengthening and expanding influences of the country’s IT companies.

An article in the WSJ states that the potentially largest IPO in history, with unprecedented investor excitement, was personally stopped by Xi Jinping. Merging and increasing in power high-tech, online commerce and finance companies have been a driver of growth in the US market, but have displeased Chinese leaders. This potentially casts a shadow over the growth of the entire market, where authorities can restrict online trading as they did five years ago.

The FxPro Analyst Team