Market focus on U.S. ADP Employment and FOMC Statement

August 01, 2018 @ 16:23 +03:00

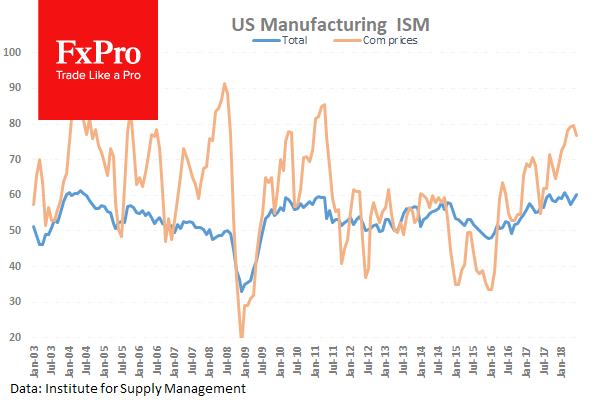

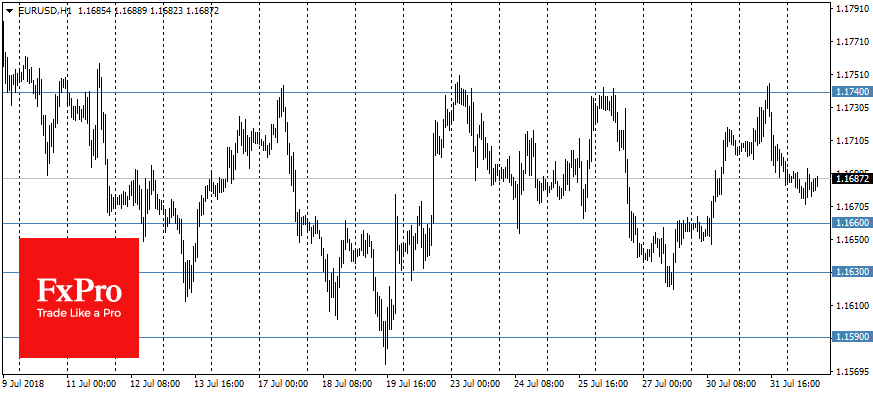

Good US data contributed to the EURUSD reversal from the resistance area around 1.1740. The dollar was helped by statistics on the growth of the Chicago PMI index to its highs since January, which reflects increased business activity after the slowing down in February-April on fears around the negative effects of tariffs on steel and aluminum. Later the strengthening of the CB’s Consumer Confidence index supported the positive tone. Both releases demonstrated improved economic performance despite the expected downturn, somewhat reducing the concerns about the immediate impact of fears on the economy’s trade wars.

Strong American statistics contributed to the reversal of the EURUSD down from the area of 1.1740, which the pair has not been able to steadily overcome for the last three weeks.

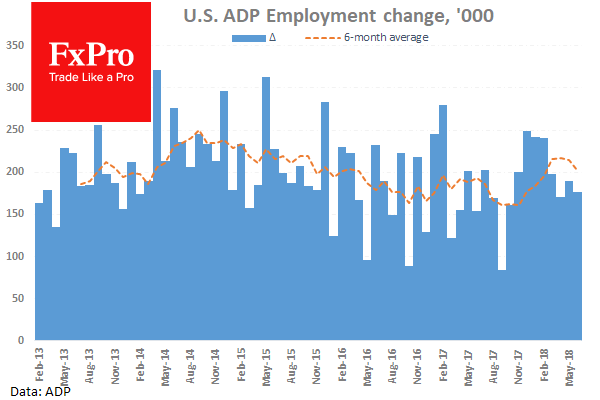

Today, the markets’ attention is focused on PMI publications from Europe, as well as data on employment in the private sector from ADP and Manufacturing ISM for the U. S. These indicators are able to seriously adjust the expectations of the Friday employment report and affect the position of the dollar on forex.

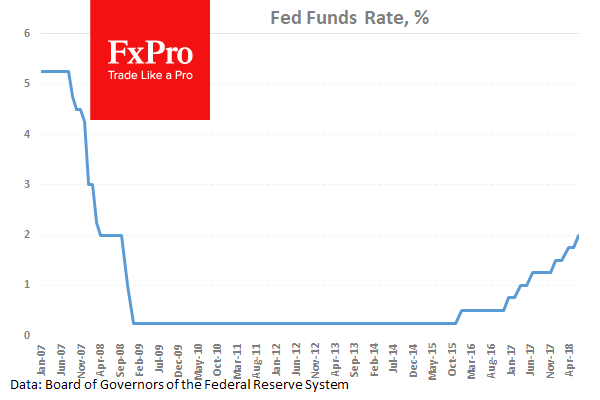

The Fed’s decision on the interest rate will be published later today, with the market expecting that Fed will keep the rates at the current level this time. All the market players’ attention will be focused on the accompanying statement and possible hints for the raise of the rate in September. Interest rate futures show 91% probability of this step, leaving room for the market reaction in case of transparent hints for this step in September.

Important milestones on the EURUSD way down will be the consolidation area at 1.1660 and 1.1630, where the couple received support last week.