Lira’s fall reached Erdogan’s pain point

December 21, 2021 @ 11:20 +03:00

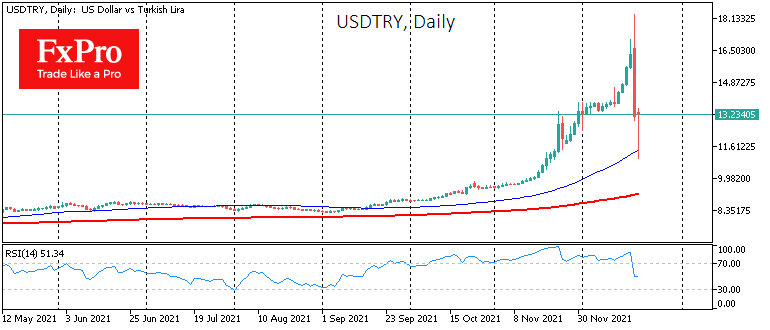

The Turkish lira gained 40% in the past 13 hours, sending USDTRY from 18.3 to 11. Despite the impressive amplitude, the exchange rate is only back to levels of a month ago.

There is no doubt that behind such a sharp strengthening were interventions by the central bank, which decided to spend a significant portion of its already meagre reserves to stem the chaos in the financial market.

Interventions alone won’t solve the situation, so to make a move looking bold, the Turkish president has announced compensating lira deposit holders if the currency’s fall exceeds the return on dollar deposits. Exporting companies will get the lira forward rate directly from the central bank as lira buyers have disappeared on the open market.

There is a lack of important details, but it most likely means that more national currency will be printed, increasing the pressure on its value. In our view, this is a sure step towards hyperinflation.

Since the end of last week, the currency crisis has taken on more and more signs of a financial crisis, as the fall in the lira began to pull the stock markets, bringing trading to a halt. The surge in the lira promises to hurt the market even more in the short term today and in the next few days.

It seems that the lira’s fall has reached the pain point of the Turkish president and government. Although we and the markets, in general, have doubts about the correctness of the announced measures, still, the very appearance of these steps should signal an exit for speculators who have been betting on a collapse of the lira in recent months.

The FxPro Analyst Team