Japan can’t stop yen collapse

April 19, 2022 @ 15:25 +03:00

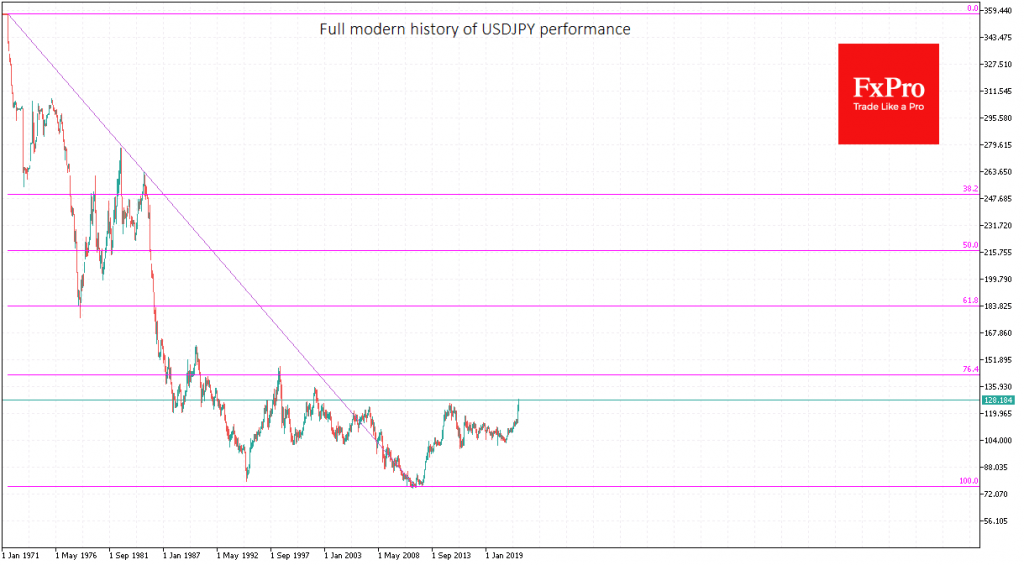

The pressure on the Japanese yen persists in the markets. The USDJPY has been hitting 20-year highs almost daily since last week, rising 11.8% to 128.40 since early March.

Since the beginning of the year, the yield spread between the 10-year US and Japanese bonds has doubled to 2.7%, on the back of rising US performance, which has sharply increased the attractiveness of US long-term bonds. The currency in such an environment works as a shock absorber, returning competitiveness to the economy.

However, in the USDJPY equilibrium exchange rate equation, you also must add the changed reality with the surge in prices of commodities and energy imports in Japan. Capital is leaving the country, taking refuge in the USA or commodity-exporting countries that can now enforce the tighter monetary policy.

A hand-tied Bank of Japan is unlikely to be able to offer anything serious to reverse the yen. It’s also not in the interests of the country’s finance ministry, which could use a weaker yen to deflate its enormous government debt.

This opens the yen up for further declines, potentially into the region of 140 per dollar, where the exchange rate was last seen during the Asian debt crisis, and even earlier, in the early 1990s, when the world last experienced a similarly high rate of consumer inflation.

The FxPro Analyst Team