Inflation in Germany does not prevent DAX40 and EURUSD from rising

June 20, 2022 @ 17:38 +03:00

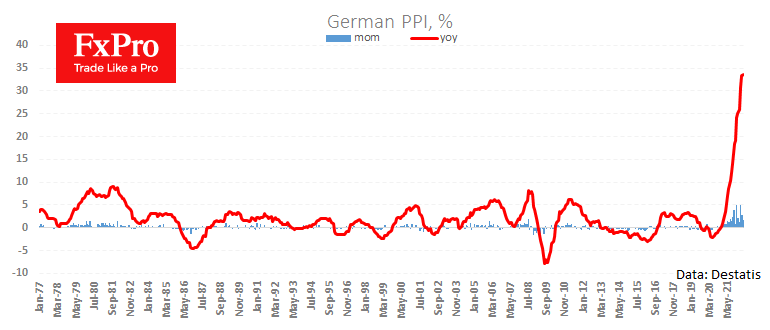

Still no sign of a slowdown in German inflation. Fresh data marked a 1.6% rise in producer prices for May and an acceleration to 33.6% y/y, suggesting further upward pressure on consumer inflation in the coming months.

The fresh batch of data should put the European Central Bank’s focus back on fighting inflation. In previous weeks we have seen that the ECB is preparing to embark on a rate hike and is ready to move at an accelerated pace which should change the market reaction to the inflation data.

In previous months the price hike was recouped by the market through selling the euro as the real purchasing power of the single currency declined sharply. However, we can now see that the ECB’s rhetoric is tightening following the price increase. The markets are setting themselves up for the first hike of 25 points in July and a 50-point hike in September.

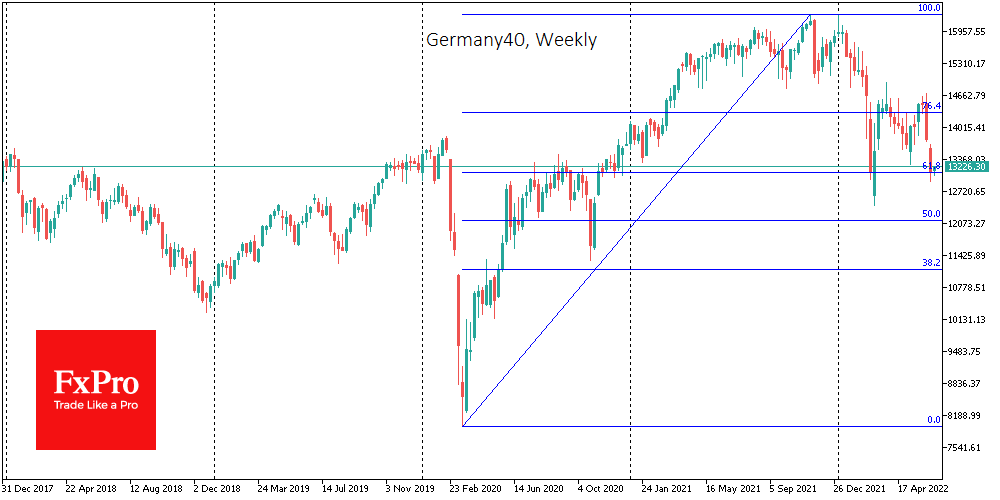

Interestingly, European markets are showing positive momentum on Monday with no fear of the ECB tightening tone. German DAX40 is gaining support for the second day after sliding below 13,000, which also passes the 61.8% retracement level of the move from the March 2020 low to the November 2021 high. This level was also a significant resistance in the second half of 2020 and is now major support.

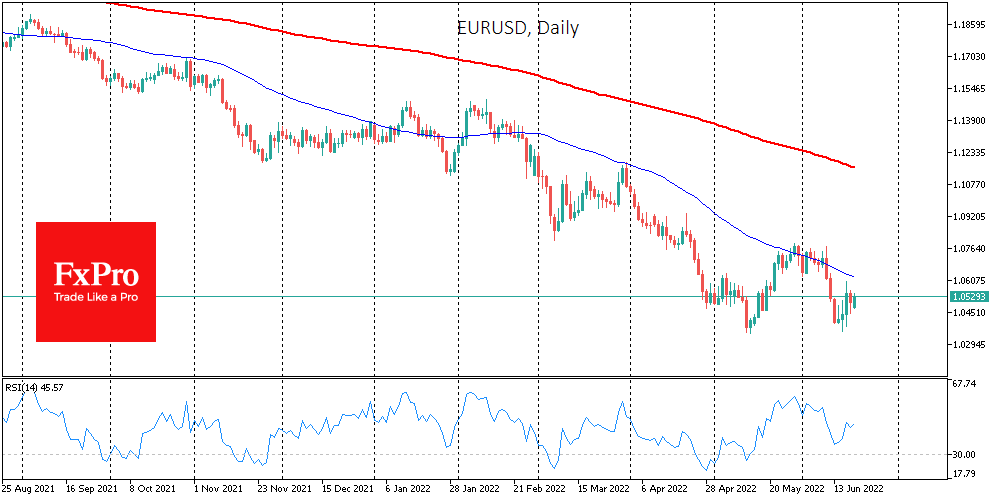

EURUSD is back above 1.05, cementing the rebound from the ‘double bottom’ near 1.0350, almost repeating the lows at the turn of 2016 and 2017. However, as long as EURUSD trades steadily below the 50-day average (now at 1.0625), it will be premature to talk about a trend reversal.

The FxPro Analyst Team