Impressive Nasdaq100 march hits obstacles on Wednesday

August 15, 2022 @ 12:55 +03:00

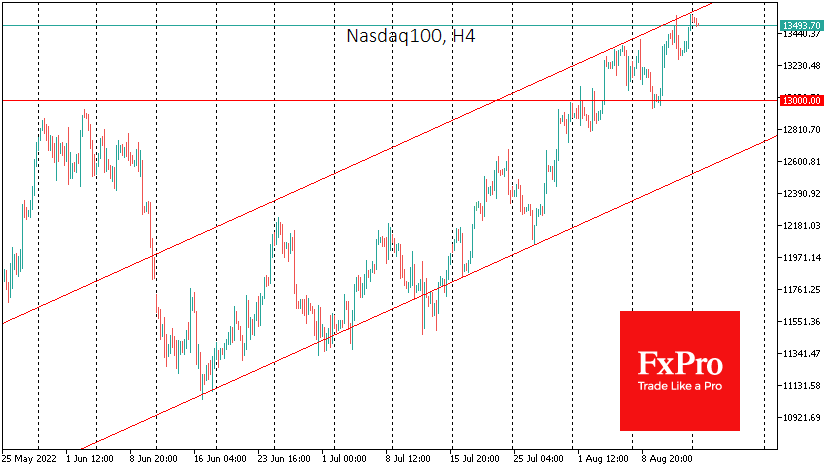

The US stock market recorded the third week of gains, allowing the Nasdaq100 to add 2.1% and overcoming several meaningful resistances, potentially clearing the way for a further leg up. At the same time, local technical overbought conditions have accumulated.

Much of the growth is centred around expectations of a Fed move, which may not materialise.

The following factors are on the side of the stock market bulls at the start of the new week. The S&P500 has already regained more than half of its losses from the peak to mid-June lows. The Nasdaq100 is up over 20% from the lows. The 13000 level has moved back into support from resistance.

The risk sentiment improves after positive macroeconomic data: considerable job growth with tempered wage increases and inflation slowdown. That was the goldilocks combination investors wanted to see.

However, this week markets should put the hope of solid macroeconomic fundamentals to one more test. The Fed will release its industrial production data on Tuesday and the last FOMC meeting minutes on Wednesday. In addition, on Wednesday, we see July retail sales, and on Thursday, existing home sales. The Fed and retail sales may be enough for the indices and overall market sentiment to turn lower on Wednesday, disappointing investors.

We also note the overbought conditions on RSI at Nasdaq100 daily timeframes. The 200-day moving average now runs near the 14000 level. It worked effectively as resistance in February and April. And by the new test of this level, critical for managers and traders, the market evolved rather tired after two months march. In such an environment, a correction or a prolonged consolidation to clarify the economic and monetary outlook is more likely.

Should the Nasdaq100 close above 14000 by the end of the week, we would say another bull run and more likely end the bear market in US equities. Coming back below 13000 would suggest that last week was a false break-up, and the bears but not the bulls are returning to the markets after the summer break.

The FxPro Analyst Team