Hang Seng meltdown

November 15, 2024 @ 14:38 +03:00

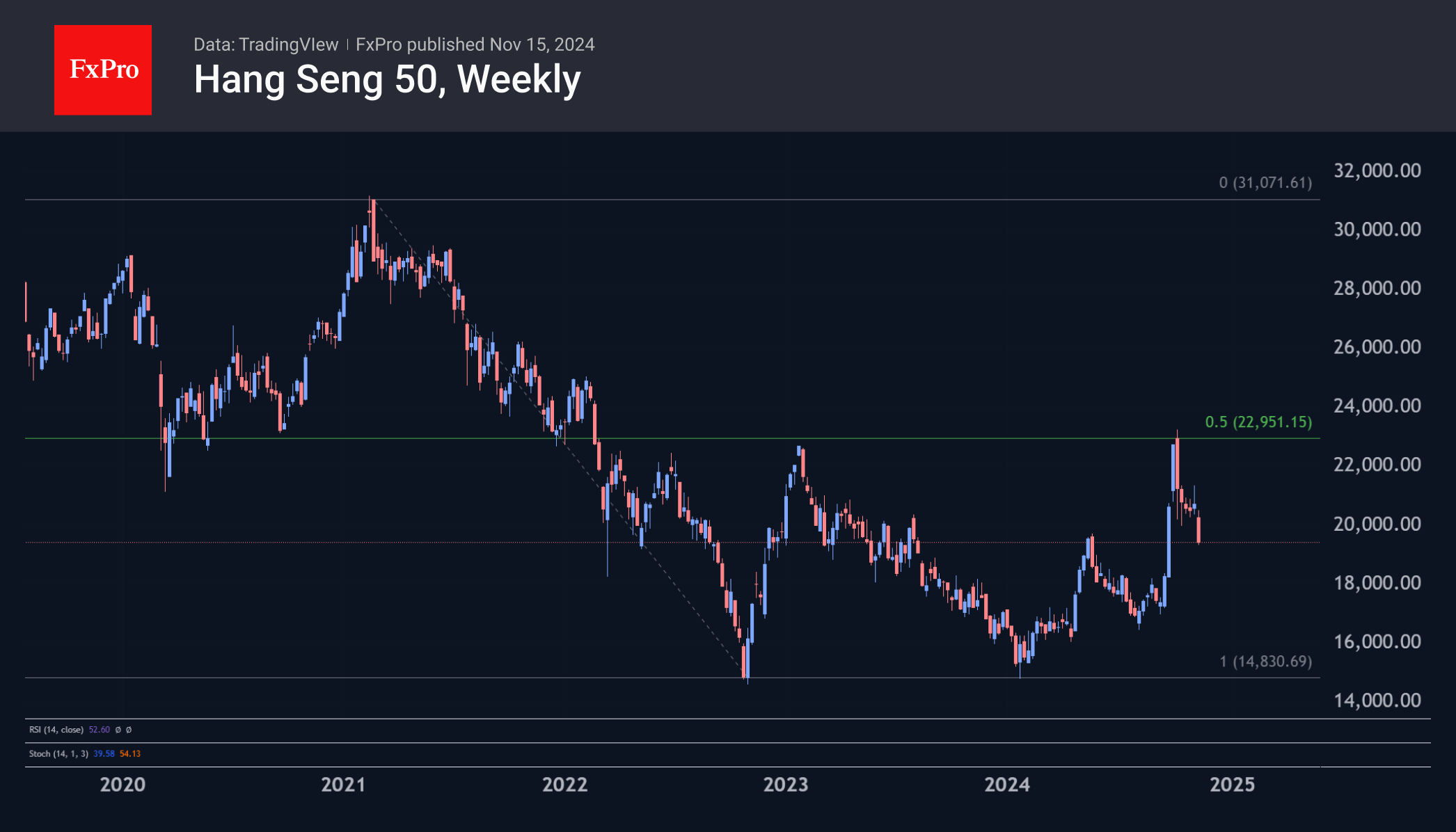

Our attention has also been drawn to the Hang Seng Index, which is down 20% from its early October peak. Technically, this is the start of a bear market after a sixth week of declines and a pullback to the May peak.

Trading volumes in Chinese equities are breaking records as investors have conflicting views on the market outlook. Many say the stimulus announced is insufficient, while some fear trade wars. Only 15% of the 40% gain since the September lows, when the rally began, has been retraced. And that’s still more than 30% from the lows at the start of the year.

On the bearish side, the index has two peaks near the same 22500 area at the beginning of last year and the end of this year. This has allowed the Hang Seng to recover only half of its original decline from a high in early 2021 above 31000 to a low in late 2022. It is too early to say whether we are in for a third test of 14500, the low of the last two years, but there is no sign of a turn to the upside either, suggesting further declines in the medium term.

The FxPro Analyst Team