Growth in markets masks debt problems

August 26, 2020 @ 13:25 +03:00

The phrase “winner takes it all” has never seemed as accurate for markets as it now, as recent times show high polarisation.

It is impossible to predict how long this shaky equilibrium may last. Potentially, it could be months or even years. However, history suggests that if it turns around, the decline could be long and painful. A strong reason for such a decline is the impact of accumulated debts.

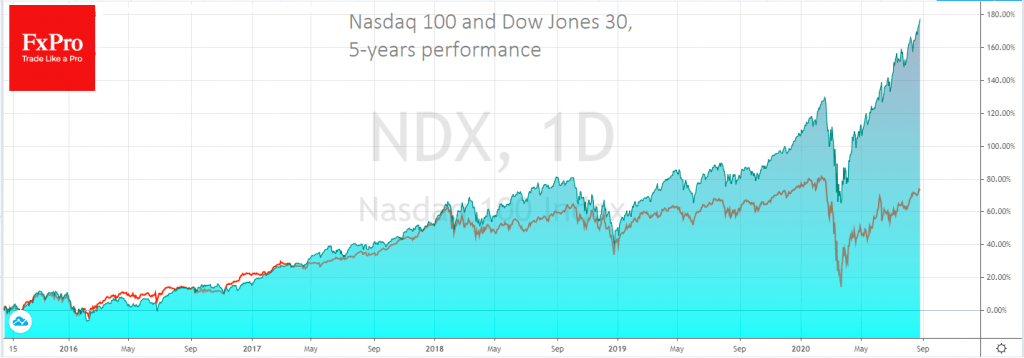

Overnight, S&P500 and Nasdaq100 once again rewrote their historic highs. At the same time, Dow Jones 30 closed the day in red, remaining 4.7% below its February highs. The composition of the indices explains this difference: the bias in high-tech stocks within the Nasdaq explains its overperformance in the last year.

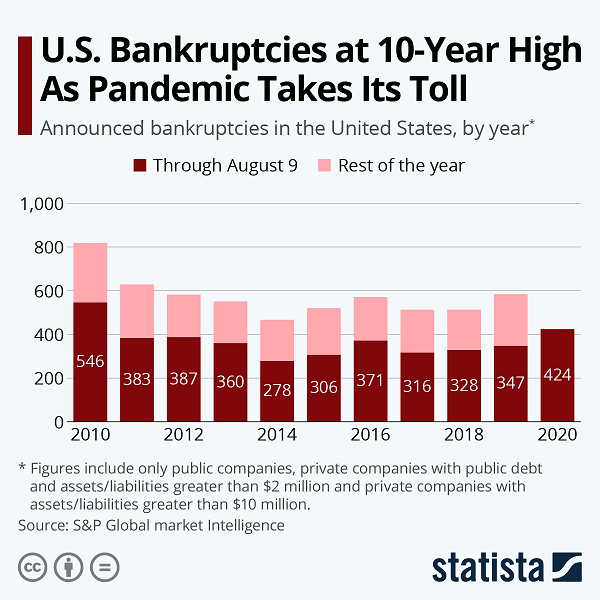

However, this growth in stock indices conceals bankruptcies, which year to date in the US has been the highest in 10 years.

The situation is no better in China, where there is an almost two-fold increase in bankruptcy applications compared to last year, reaching 9,700.

To varying degrees, the outlook is similar in other countries that have found themselves between the two economic poles.

This information does not harm the overall demand for assets, as we don’t see loud and unexpected bankruptcies. After all, companies with any signs of life are actively placing bonds on debt markets at low rates.

Access to credit allows them to borrow more corporate debt. However, we should not forget about the Greek experience. Sooner or later, the burden accumulated becomes too heavy to bear, even amid low-interest rates.

In the mildest case, there is a long period of deleveraging, i.e. reducing the debt burden. This is a painful period of cost consolidation, which hurts the growth rate of the company or country and often forces investors to turn away from these assets.

History suggests that deleveraging stretches for an average of 7 years, the first half of which may be the most worrisome and cause major shifts in financial markets. In particular, investors’ favourites maybe those companies and economies that now have better debt characteristics. This should play in contrast to the approach currently popular: the more stimulus, the higher the potential.

The FxPro Analyst Team