Gold’s cup-and-handle pattern?

April 20, 2022 @ 12:37 +03:00

Gold is falling fast, having lost about 3% to $1940 from Monday’s peak. On Monday, the bulls are locally capitulating after an unsuccessful attempt to push the price above $2000.

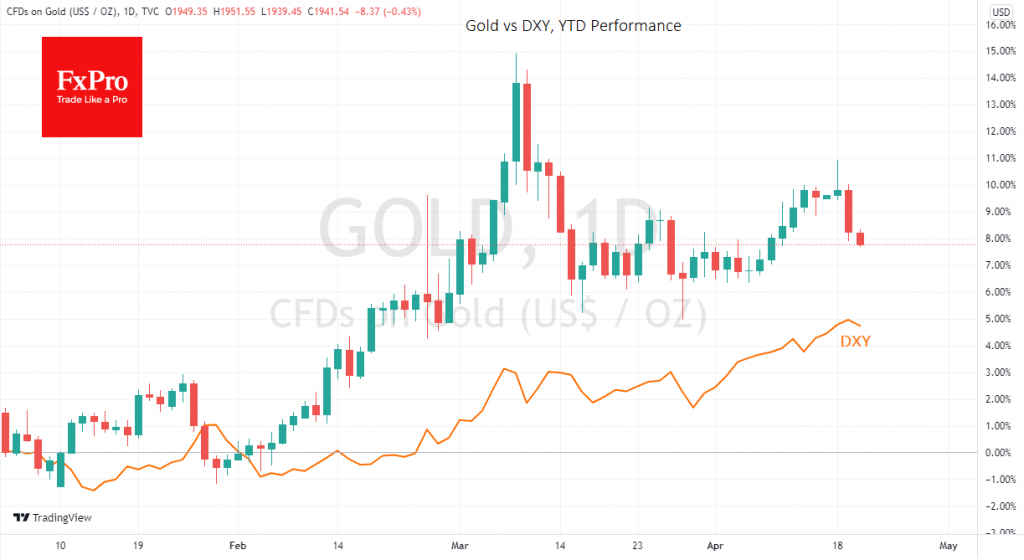

It would be a mistake to attribute gold’s fall to an expensive dollar. Since the start of the year, the dollar index and gold have had a more than 80% correlation versus -0.34% in 2021, reflecting that investors see gold and the dollar as defensive assets amid the Russia-Ukraine conflict.

Yesterday the dollar index slowed its rise towards the end of the day. It reversed to a decline on Wednesday morning, while gold has been actively declining since the beginning of the week, reinforcing their close correlation.

Gold’s recent retreat could be a sign of hope for a détente in the European conflict and a desire to lock in profits from the powerful movement of recent days. As it is difficult to find signs of de-escalation in the news, we are leaning towards the second option.

With EURUSD near 1.08, GBPUSD near 1.30 and USDJPY one step away from 130, the dollar is near historical extremes. The same can be seen in the Dollar Index, which since last week has been trading above 100, a psychologically crucial round level.

Since the beginning of February, gold has found support on the declines toward its 50-day moving average in the last rally. If a test of this level in the coming days also confirms the resilience of this support, we could see a new high soon.

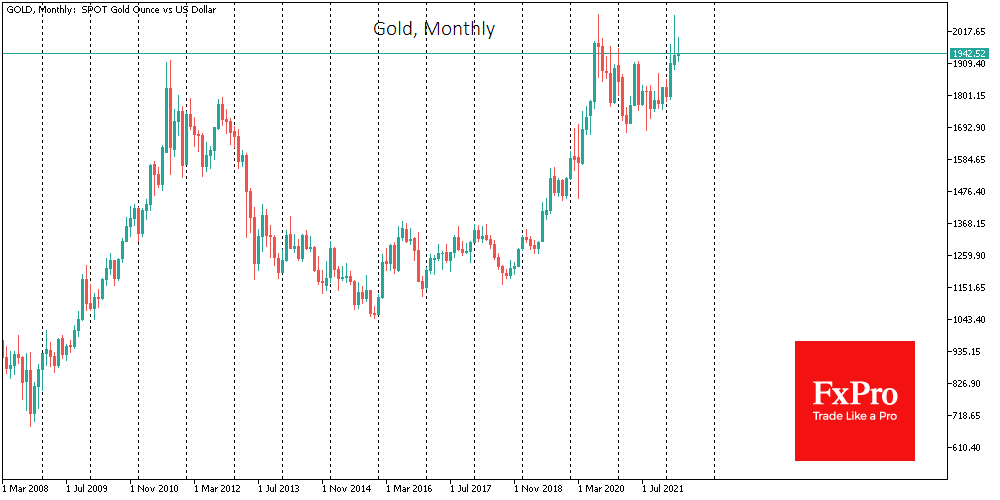

On the long-term gold chart, the pullback from the highs in 2020 and the subsequent smooth recovery is a handle in a “cup-and-handle” pattern, whereby a cup has formed over eight years since 2012. This pattern will gain strength should gold consolidate above $2000 with a final target near $3000.

The FxPro Analyst Team