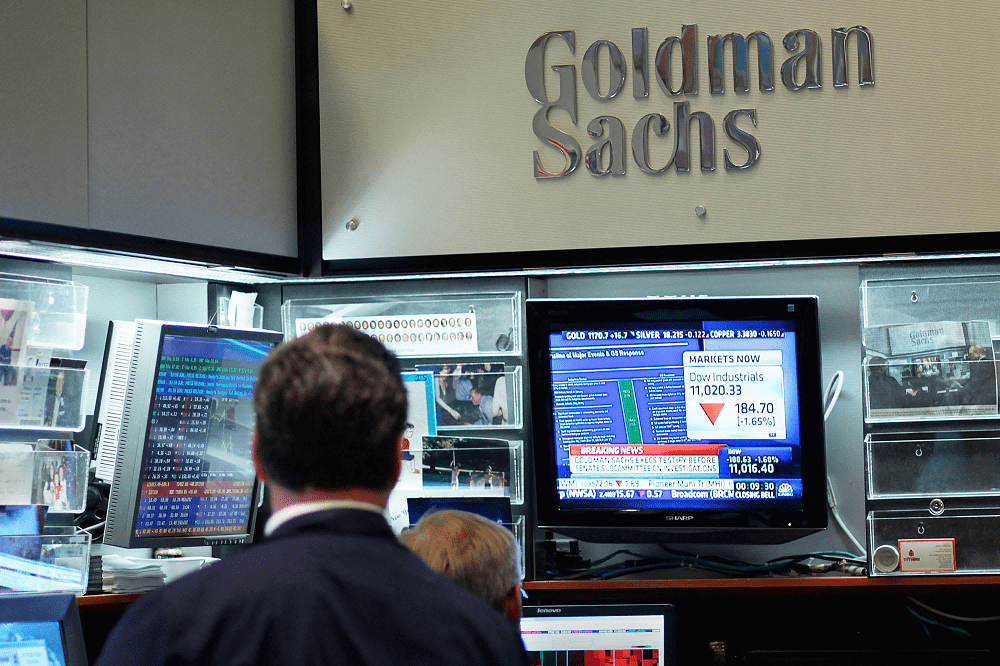

Goldman Sachs bets against the dollar as economies reopen

June 01, 2020 @ 16:04 +03:00

Goldman Sachs has begun to establish short positions on the dollar as the reopening of economies is expected to lure investors out of the traditional safe-haven currency. In a note over the weekend, Goldman strategists said that while they had maintained that it was too early to look for “outright and sustained Dollar downside given the balance of cyclical risks,” shorts on the dollar now looked attractive in certain currency crosses.

Goldman cited the “steady reopening process, limited evidence of a pickup in Covid infection rates, and encouraging policy actions like progress on the EU Recovery Fund,” a 750 billion euro ($834.1 billion) borrowing program designed to help shore up the European economy in light of the coronavirus pandemic.

In particular, they highlighted the Norwegian krone as being well-positioned to outperform during the remainder of the coronavirus crisis, and recommended shorting the USD/NOK pairing with a target price of 8.75 krone to the dollar, with a stop if the krone depreciates to 10.25. The krone currently sits at 9.68 to the dollar.

Short selling a currency involves borrowing that currency, selling it at the current market price and then waiting for the price to fall in order to buy the currency back at a lower price and return the loan. The short seller therefore profits if the currency depreciates over that time period.

As of Monday morning, Norway had reported 8,440 cases of Covid-19 and 236 deaths, having taken stringent measures to curtail the virus as early as March 12 and developed a substantial testing capacity.

The country also announced a three-phase fiscal stimulus plan in March and developed two state-backed loan and guarantee schemes to provide liquidity for Norwegian businesses.

Goldman Sachs bets against the dollar as economies reopen, CNBC, Jun 1