Gold turned up, despite stocks and USD growth

November 14, 2019 @ 11:28 +03:00

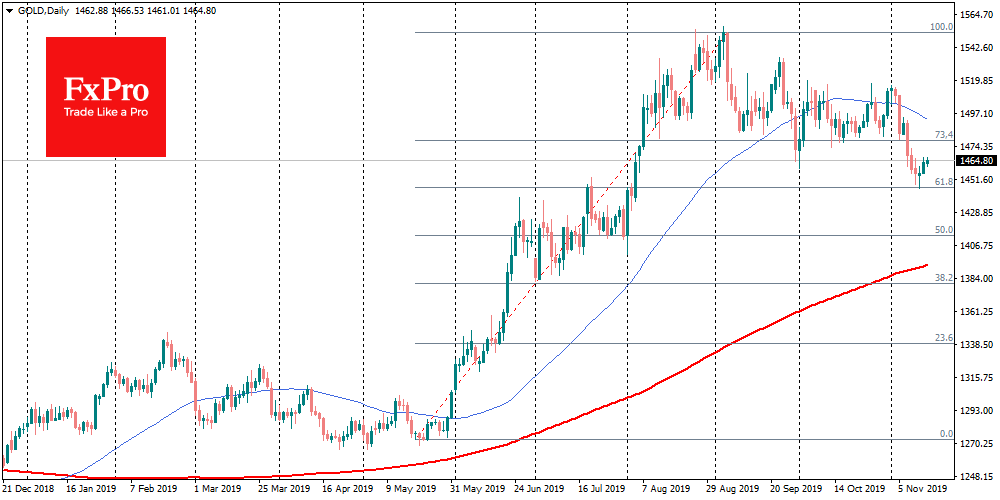

Last week was plenty unsuccessful for Gold. It was the worst week over the previous two years, as the precious metal depreciated by 3.6%. Started this week with a decline, the Gold found support near the $1,450 area, from where it turned upside.

The reason for the pressure on Gold in November is the recovery of demand for risky assets. Also, this month, the dollar returned to growth, affecting the valuation of raw materials and many other assets. However, Gold does not merely have an inverse correlation with stocks. Interest in it is also associated with actual and expected inflation: the higher it is, the more attractive the investors consider the purchase of Gold.

The influence of the dollar price on Gold should be questioned, as in the last two days, we have seen their simultaneous strengthening. Besides, the US and European stock markets have also been growing, albeit very cautiously. The simultaneous growth of these three assets is sporadic, and in this case, Gold has better chances to develop its growth. It seems that this precious metal corrected the increase during the May-September rally by its rollback to the 3-month low.

It is also worth taking a broader look. Asian stock markets are storming this week, which attracts interest in Gold as insurance for Asian investors.

Looking at the technical factors, Gold received support, declining by around $100 from the peak levels of September when it was climbing up to $1,557. The same levels in $1,450 are a correction of 61.8% in Fibonacci, which considered as an essential level for supporters of technical analysis.

The American markets seem to stuck near the top. In case of their reversal to decrease, the attention of investors may well return to Gold, which can quickly jump back to the levels above $1,500 this month, and possibly above $1,550 to the by year-end.

The FxPro Analyst Team