Gold tries to prove that the bull trend is not yet broken

February 06, 2026 @ 19:14 +03:00

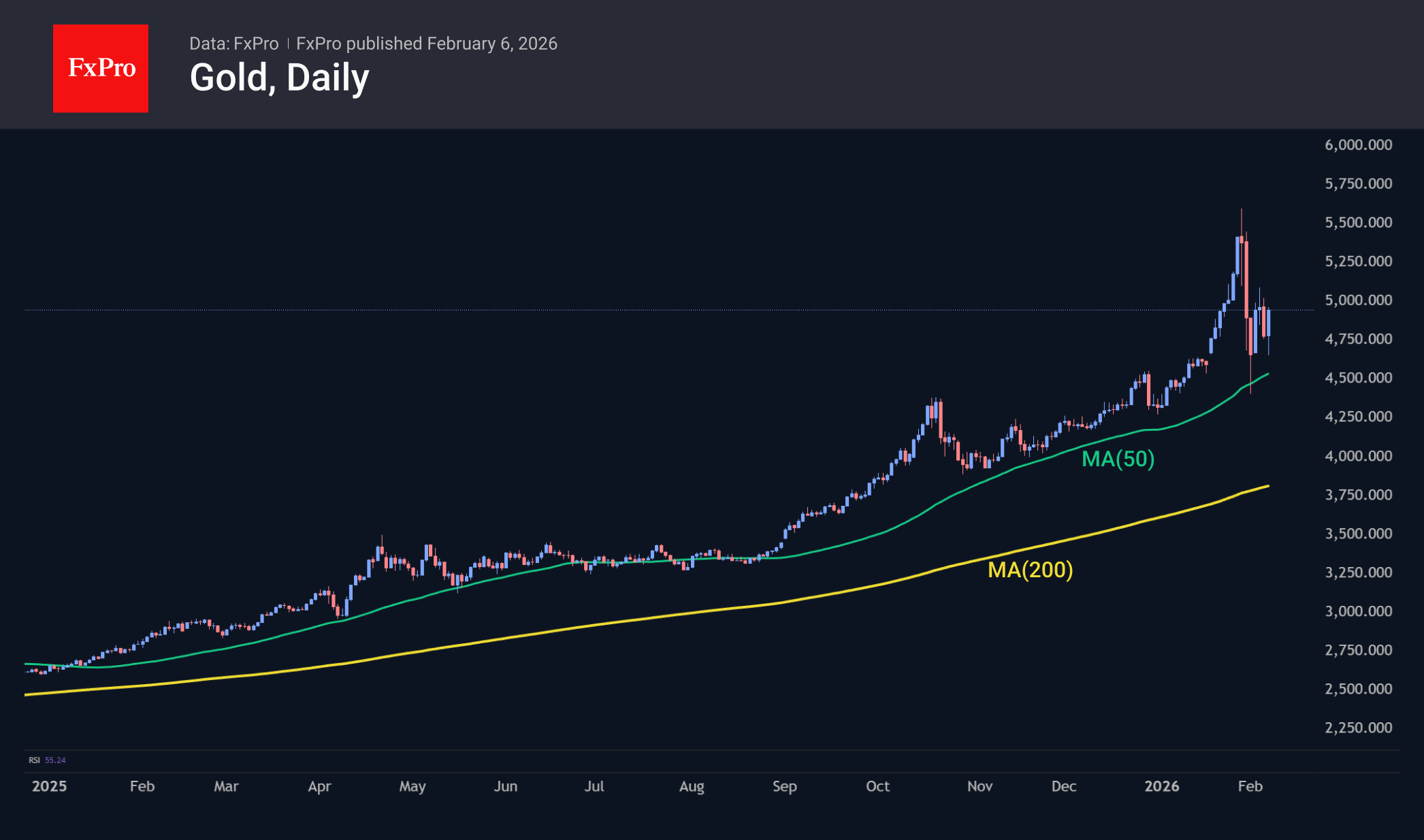

After the most significant sell-off since 1980, gold is attempting to stabilise. Bears argue that the bubble has burst and events will unfold as they did in 2011. Back then, after falling from record highs, the precious metal entered a multi-year downtrend. Bank of America notes that volatility remains elevated. This allows us to talk about gold as a speculative asset and reduces central banks’ demand for bullion. This is especially true given some recovery of confidence in the US dollar.

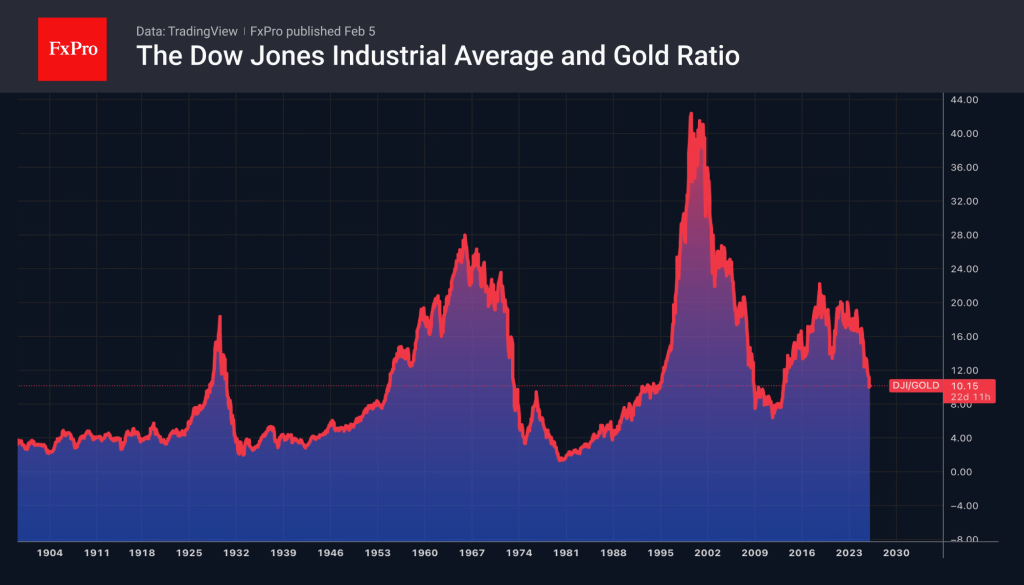

Bulls argue that the fundamentals of the gold market remain intact. US government debt is growing rapidly, which devalues Treasuries and the greenback. Political and geopolitical risks remain high. The Fed will resume its cycle of policy easing. Also, precious metals do not seem expensive at these levels. The Dow Jones index exceeded its value by 1.3 times in 1980, and during the dot-com crisis, its ratio soared above 40. Currently, it is just over 10.

Events at the end of last week unfolded too quickly. By the close of last week, the collapse had reached historic proportions, leaving scars on the market at the start of February. Formally, we see the week closing in positive territory and an impressive rebound of $550 from Monday’s lows. It is also worth mentioning that the price reached these levels for the first time just two weeks ago. Nevertheless, we remain in the bear camp, assuming that the three-year bull market has already been broken. We may see attempts to grow and even break through $5000, but we expect that too many will sell gold at these levels.

The FxPro Analyst Team