Gold: preparing for a breakout or a reversal? The dollar will decide

January 16, 2024 @ 18:46 +03:00

Gold lost 0.8% on Tuesday to $2037 due to the impact of a rising dollar after policymakers in Davos flagged overly optimistic expectations for an interest rate easing cycle.

Commentators are trying to find a link between hawkish comments from eurozone (not US) policymakers and the rise of the dollar. But we tend to see a technical pullback behind the USD strength after markets clearly jumped over their heads in their expectations, laying down rate cuts at every Fed meeting since the March meeting.

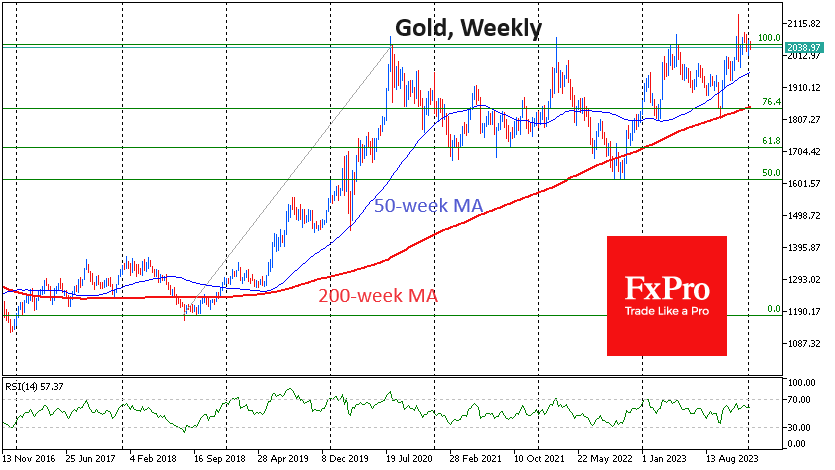

But in gold, another trend can also be highlighted. During the October-December price update of local highs, the RSI index on daily timeframes recorded a sequence of declining local peaks. This is a sign of bullish momentum exhaustion. We saw a similar one in March-May last year when a five-month downward trend followed the formal renewal of historical highs.

The price climbed a bit higher in October and experienced a powerful short squeeze at the start of last month. But since then, the market has been finding a balance of around $2040.

These are historically high levels, and the lull here may turn out to be both a period of consolidation before further growth impulse and the start of the bear market. The dynamics of the dollar, in this case, may turn out to be the final determining force.

Further strengthening of the dollar from current levels promises to significantly increase the pressure on gold, which is losing its attractiveness against the background of high yields on US bonds, supported by the growth of the US currency. A crucial intermediate stage in this case will be the level of $2020. The 50-day moving average, which has been a significant support level since November, is located there.

If the last impulse of the dollar is just short-term profit-taking, the gold bulls will have enough strength and liquidity to launch a new wave of price growth with the renewal of historical maximums and the final target above $2500.

The FxPro Analyst Team