Gold is near its peak

January 19, 2026 @ 16:24 +03:00

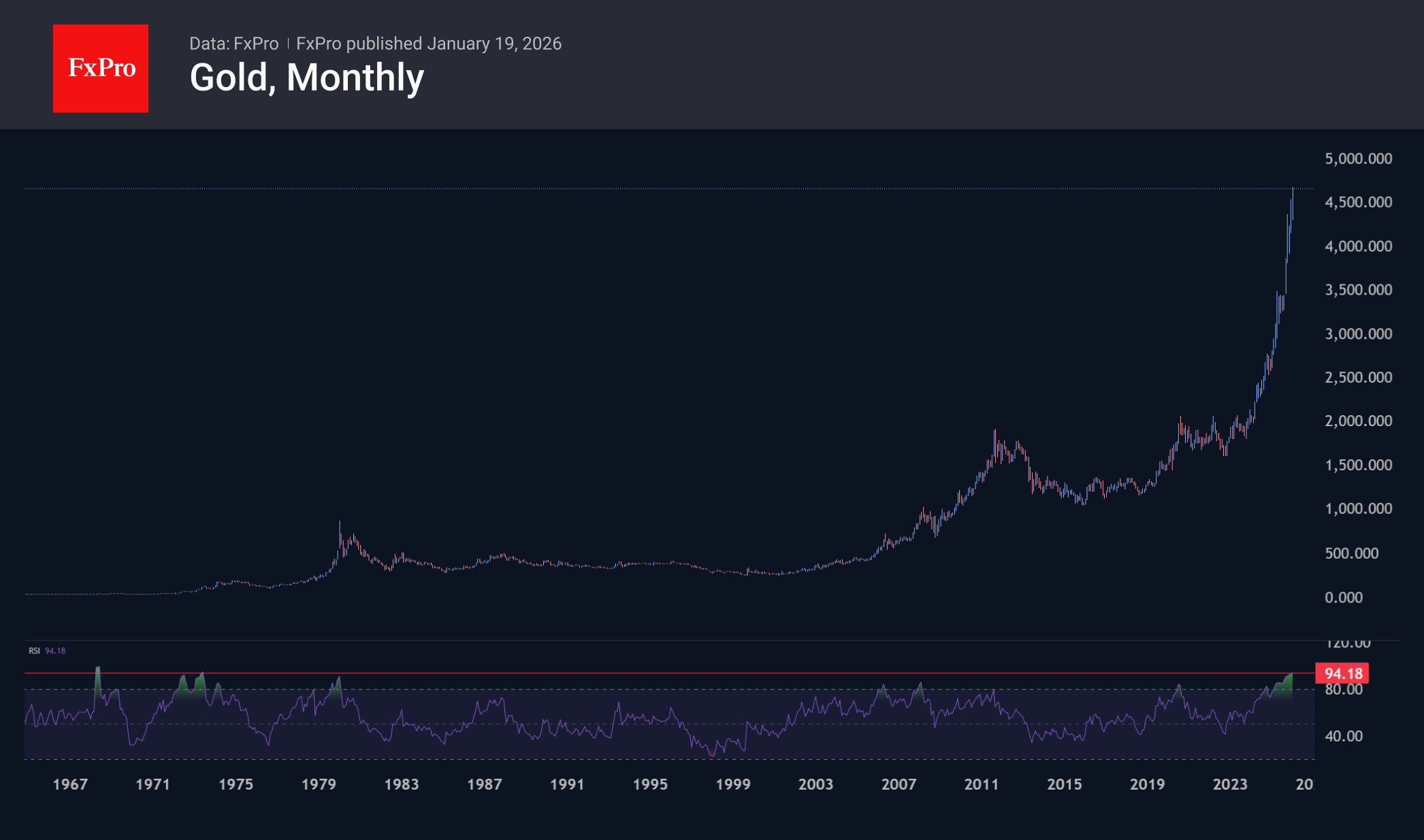

Gold once again hit historic highs at the opening of trading on Monday, approaching $4,700 on the spot market and exceeding this level in some futures contracts. The move was driven by a new round of tariffs against several NATO countries and promises of retaliatory measures in response. As seen in April, tariff uncertainty is fuelling demand for gold and triggering a sell-off in US assets, from bonds and the dollar to equities.

Gold’s position looks strong amid extremely unpredictable geopolitics and ongoing tensions. The increasing polarisation of the world is forcing central banks to continue the processes of de-dollarisation and diversification of reserves. Although central banks remain net buyers, their purchase volumes are declining amid more than 130% price growth over the past two years, pushing prices to historic highs.

On monthly timeframes, the RSI rose above 94, a level reached only once in modern market history in 1973 and approached again in January 1980 after a record year of growth. In both cases, this was followed by months of sharp declines. In the first instance, gold returned to its highs six months later, while in the second, the bull market was broken, leading to a two-thirds decline over the following two years. In both historical examples, upside momentum faded for several months after such extreme readings.

Our attention is also drawn to reports of a huge volume of short exchange positions held by active funds. At current prices and dynamics, especially in silver, an explosion of volatility could occur at any moment. This could be either the start of a sharp downward movement or a final short squeeze with growth to non-market levels, which could ultimately remove buyers from the market.

The FxPro Analyst Team