Gold hits new highs due to political turmoil

October 10, 2025 @ 15:24 +03:00

Gold is outside the realm of politics. While currencies and securities depend on the actions of presidents and governments, precious metals do not. Therefore, political turmoil forces investors to use them as safe-haven assets. The impressive 52% rally in gold started in April with the introduction of tariffs on America’s Liberation Day. It continued due to the US government shutdown, the political crisis in France, and the change of leadership in Japan.

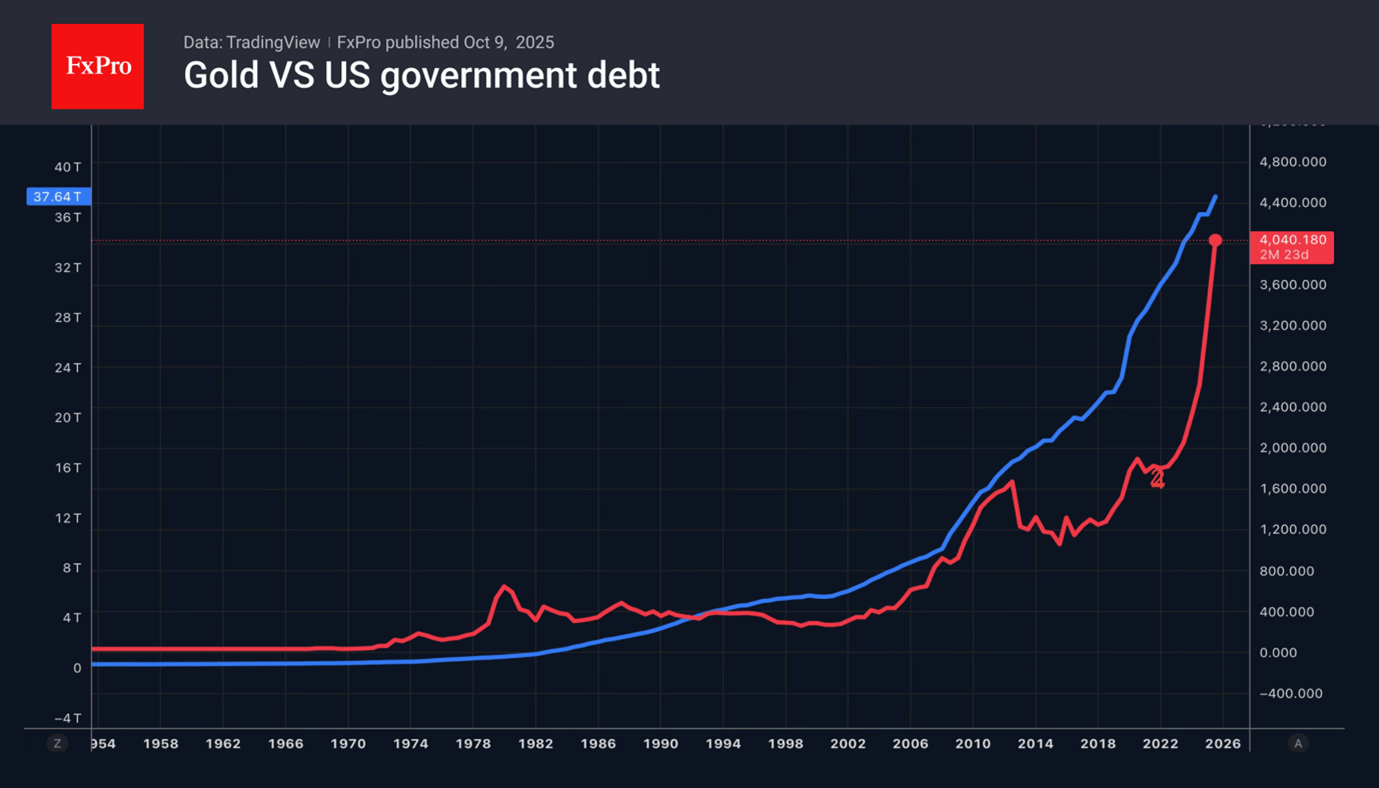

The rise of gold above 4,000 dollars per ounce is not only the result of the weakness of fiat currencies. There are tectonic shifts in the structure of investment portfolios and fears of financial crises due to government recklessness. The share of precious metals is growing both in speculators’ assets and in the gold and foreign exchange reserves of central banks. The indicator has already exceeded the share of the euro. According to Eurizon Capital, if it equals the share of the US dollar, the price per ounce will soar to 8,500 dollars.

The Supreme Court’s abolition of tariffs will inflate the US budget deficit. France does not intend to reduce it, and Japan plans to increase bond issuance. All this creates a tailwind for commodity assets.

The FxPro Analyst Team