Gold ends retreat and heads higher

November 15, 2023 @ 15:21 +03:00

Gold has made a decisive reversal to the upside this week. We are likely to see the start of a new bullish momentum with the potential to renew all-time highs above $2100.

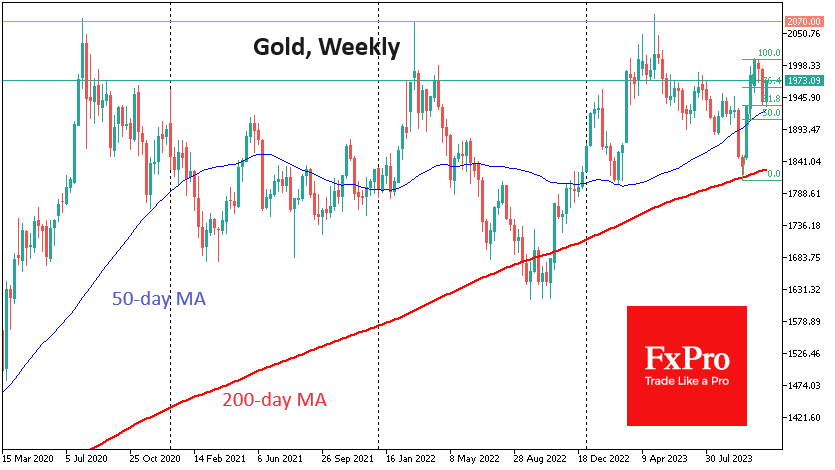

Gold rallied by $200 in October and peaked at $2010, driven by three main factors. Early in the month, gold was an attractive buy on oversold conditions and a touch of the critical 200-week moving average provided a technical reason for a rebound.

But fundamental news continued to drive the buying. The first was the US labour market data, strong employment growth with a moderate slowdown in wage growth. Then, over the weekend, the conflict between Israel and Hamas added fuel to the fire.

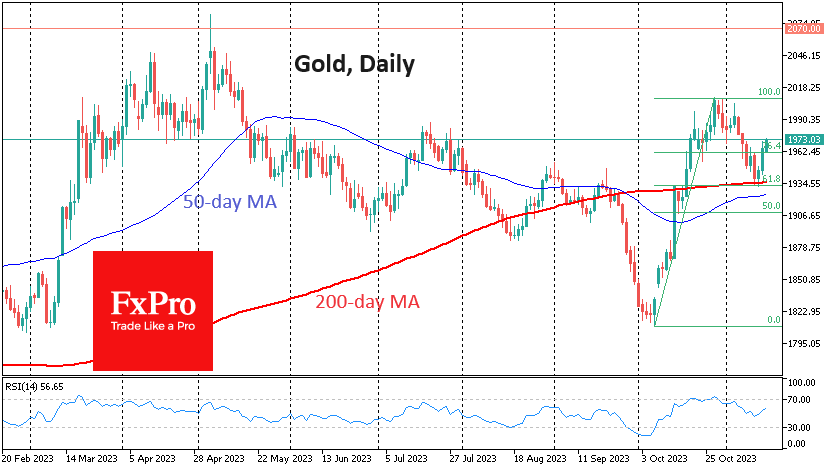

By the end of October, gold was overheated and went into a correction, which deepened in November despite the return of risk appetite in US markets after the Fed meeting. As a result, the value of the troy ounce retreated to the 200-day moving average and the 61.8% Fibonacci level of the initial spike.

Gold’s rally from these levels since the start of the week should be seen as a confident return of buyers from technically significant levels and the end of the corrective pullback. According to the Fibonacci pattern, gold’s next upside target is $2130, or 161.8% of last month’s upside amplitude.

However, this pattern will only be fully realised on a confident break of the previous local highs at $2010. A strong break above will confirm that gold is ready to settle above the crucial milestone this time. Over the past three years, gold has rallied strongly on several occasions, but these have always been upside impulses, and we soon see a reversal to the downside. The coming days will tell us if this is the case this time.

The FxPro Analyst Team