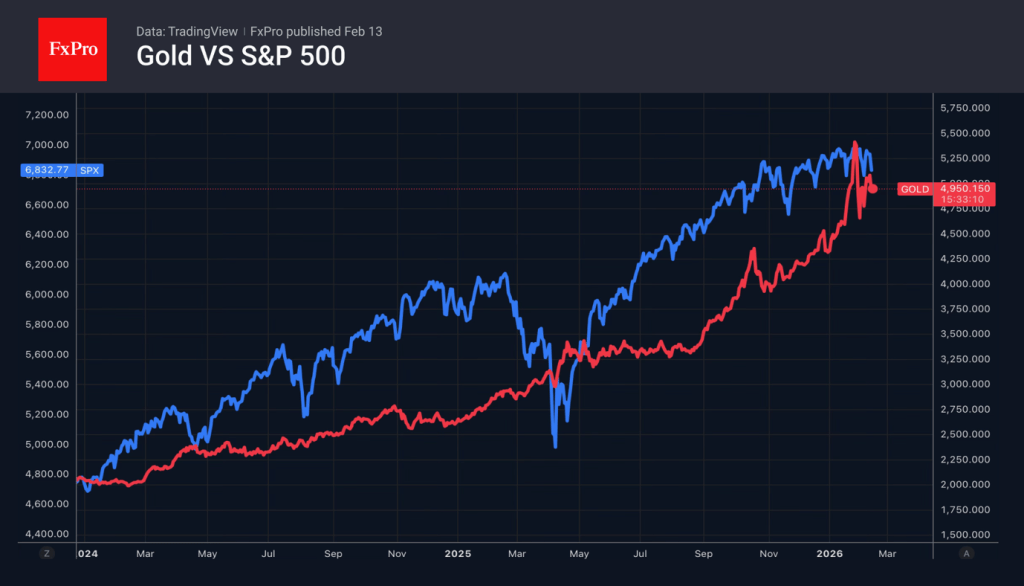

Gold drags down the stock market

February 13, 2026 @ 16:33 +03:00

• Traders sold gold to meet margin requirements

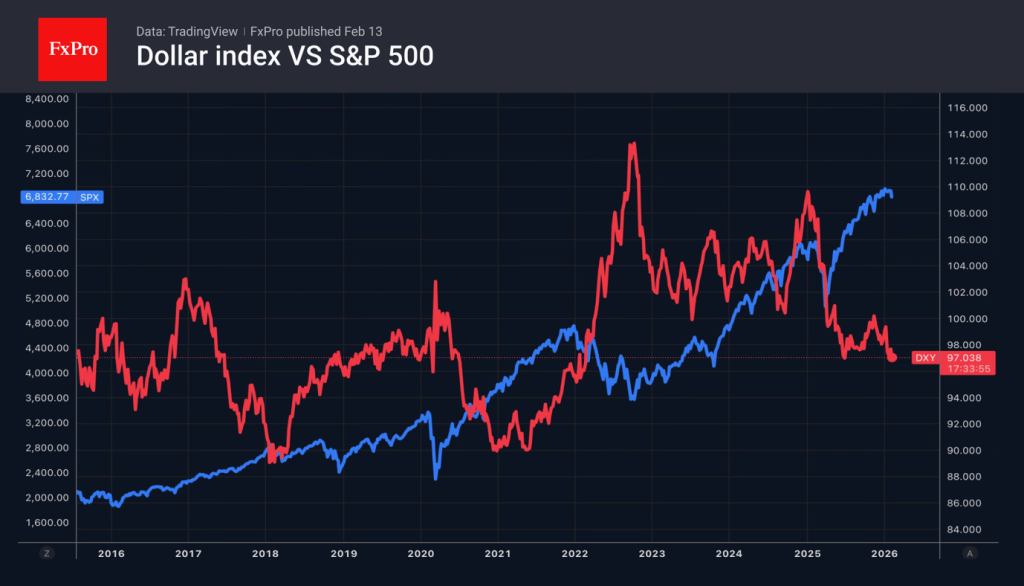

• The unwinding of currency hedging operations supports the US dollar

The worst collapse in US stock indices since November and a decline in jobless claims helped the US dollar. However, the aggressive momentum of the bears on EURUSD was held back by negative real estate market statistics. Home sales fell to a 16-month low, adding to concerns about an economic slowdown and increasing the likelihood of the Fed easing monetary policy in June from 58% to 73%.

The uncertainty surrounding Donald Trump’s policies is forcing investors to either abandon US-issued assets as part of a ‘sell America’ strategy or hedge the currency risks of investments in securities by selling the dollar. Therefore, the worst collapse of the S&P 500 in almost three months led to the closing of deals and supported the greenback.

The fate of EURUSD depends on macro statistics and the monetary policy of central banks. The futures market is confident that the federal funds rate will remain unchanged until June. 66 out of 74 Reuters experts believe that the ECB deposit rate will remain at 2% until the end of 2026. In their opinion, the eurozone economy will slow down in 2026 from 1.5% to 1.2%. This will be followed by a growth of 1.4% in 2027.

Divergence in monetary policy will play into the hands of EURUSD in the medium term, but in the near future, the wide interest rate differential will work in favour of the bears. If US inflation does not slow down, the Fed’s prolonged pause will allow the US dollar to strengthen.

The collapse of US stock indices pushed gold prices below $5,000 per ounce. This has often happened in the past, with these assets moving in tandem, as the need to maintain margin requirements on stocks leads to the sale of other assets in the portfolio. Precious metals were often among those sold off. History repeated itself, causing XAUUSD to retreat.

The Australian dollar also succumbed to pressure from bears on the S&P 500. Hawkish rhetoric from Reserve Bank officials unwilling to tolerate high inflation increases the chances of continuing the cycle of monetary restriction as early as March and puts pressure on AUDUSD. However, the Aussie remains a high-yield currency, so the deterioration in global risk appetite is leading to pullbacks to the uptrend.

The FxPro Analyst Team