Gold and silver: time to decide on the direction

August 03, 2022 @ 12:19 +03:00

Silver has pulled back 3% in the last 18 hours, while Gold has lost 1.2% in the same time frame. The pullback came as some investors exhaled after China’s reaction to the Pelosi plane landing in Taiwan. Investors were banking on a slight chance of a sharper escalation than they saw.

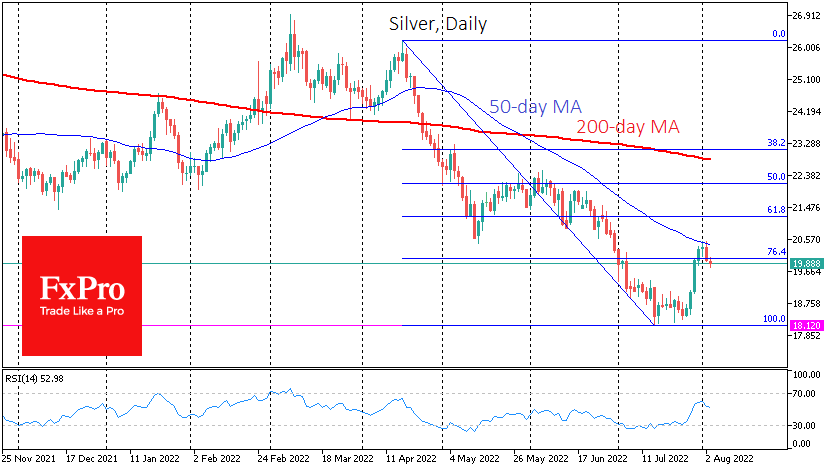

On the technical analysis side, yesterday’s pullback prevented the precious metals from breaking out of the grip of a short-term bearish trend, exposing the 50-day moving average as resistance.

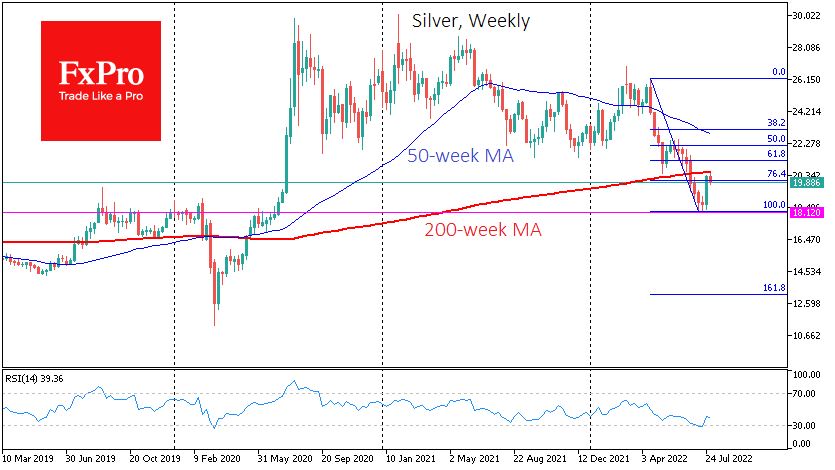

The situation, in this case, looks double-edged. A bearish view on silver suggests that the momentum of the rise since the beginning of last week was a corrective bounce to 76.4% from the declines from April’s highs to July’s lows. Resistance in the 50-day moving average served as an additional pressure factor, keeping silver within the short-term downtrend. In addition, silver also bounced back when it tried to return to the 200-week average, further encouraging sellers.

The bullish scenario in silver suggests that yesterday and today, the market cooled down a bit after the latest momentum. The drawdown to two-year lows and the previous meaningful consolidation area made silver attractive for long-term buyers. This is doubly true with easing expectations of further monetary policy tightening in the US and other major economies.

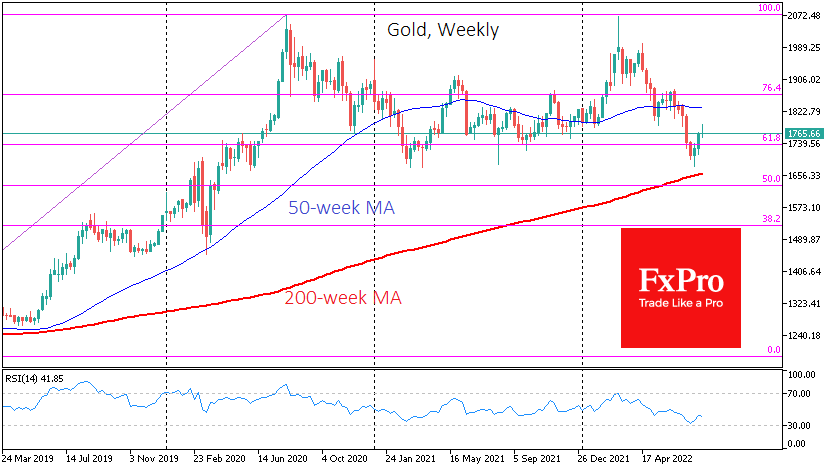

Gold has seen more sustained buying, with the price already showing positive momentum on Wednesday morning. This relatively quick return to growth suggests less about the persistence of geopolitical risks and more about gold’s continued attractiveness after touching the two-year lows earlier last month.

On the weekly gold timeframes, the RSI has been recovering strongly after approaching the oversold area and staying close to its 200-week moving average in July. Also, on the longer-term gold charts, the two-year sidewall looks like a prolonged correction after an upside impulse.

This week we see an intensified tug-of-war between bulls and bears, which might spark a further strong move in the next few years. Traders and investors, even long-term ones, should not overlook the signals that silver and gold could give this week, particularly if we see an apparent capitulation by either side.

The FxPro AnalystTeam