Gold and silver forms a base for renewed growth

September 30, 2020 @ 12:59 +03:00

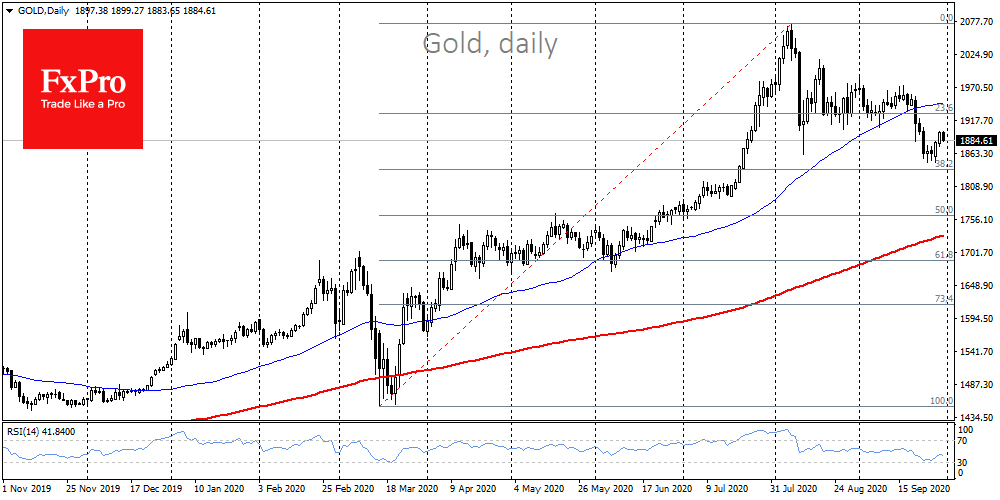

Gold prices rose above $2,000 per ounce last month, but have since experienced a sharp decline, cementing the reputation of serious resistance. The strengthening of the dollar that followed in September put even more pressure on quotations. However, the stabilization of gold and silver rates in recent days has led to a more optimistic scenario.

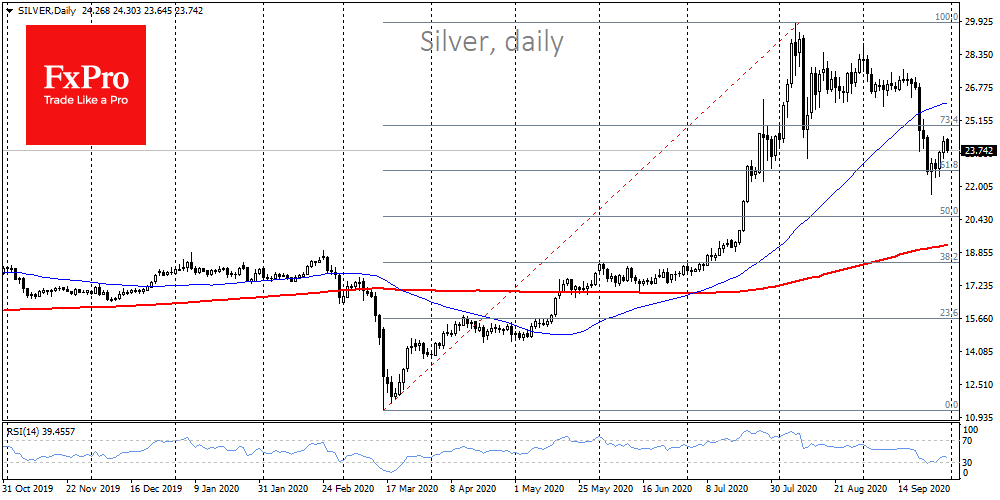

The technical picture suggests that a decline from $2075 to $1850 was a short term corrective rollback, which has significantly lost strength near the 38.2% Fibonacci retracement from March-August. Silver, however, failed to overcome its important round level of $30 at its peak in August and was dragged down by the correction of its big brother.

The bears stayed away from both gold and silver for most of September and only early last week began pushing them lower. However, it is also important to note here that these metals managed to stay within the Fibonacci correction model. Silver prices were falling below their respective line during intraday moves, redeeming them over and over again in drops.

As early as the end of last week, the bears’ pressure was exhausted, and we saw renewed purchases. Both metals are growing along with positive stock indices, which is easy to explain.

Demand for equities and some other risk assets has risen in anticipation of a new US fiscal support package. This includes tax breaks for companies, cheques for $1200 for most Americans and the reinstatement of federal unemployment benefit supplements. Earlier this year we saw all these measures supporting demand for stock exchange instruments and pulling gold and silver up. The same is to be expected now, because Americans do not immediately spend these checks, but use them to buy stocks and metals.

In the longer term, there are even more reasons to love gold and silver. After all, governments in many countries are already beginning to think about how to continue living with a historically high debt burden. Investors are afraid of some form of “financial repression” when bonds will sustain a negative return. In this case, we may well witness the formation of a new growth impulse for metals, which could take silver to new multi-year highs and gold to historic levels before the end of the year.

The FxPro Analyst Team