Global Central Bankers Say It’s Too Early to Stop Virus Spending

October 14, 2020 @ 11:03 +03:00

The world’s top central banks are urging governments to put concerns about mounting debt aside for now and keep spending until the economic recovery from coronavirus is complete. Their calls are being met with pushback in some countries, where the question of how to pay for rescue efforts is creeping up the agenda. But the International Monetary Fund, historically a champion of budget restraint, says they have a point.

The Fund is due later Wednesday to publish its most detailed study of the pandemic’s impact on public finances. Chief economist Gita Gopinath warned Tuesday of a “long, uneven and uncertain ascent” ahead after the worst slump in generations, with poverty rising and unemployment still high — and said it’s too early for policy makers to withdraw support.

That case was made with growing urgency by central bankers heading into this week’s IMF annual meeting. European Central Bank chief Christine Lagarde kicked off the online-only event by saying her biggest concern is that fiscal aid to workers and businesses may get phased out too abruptly.

A parade of Federal Reserve officials led by Chair Jerome Powell lined up last week to make the same argument with regard to the U.S., where talks on the next dose of pandemic stimulus have been deadlocked for months in Congress. Fed officials said their own tools, such as another round of bond-buying, won’t be as effective as government spending.

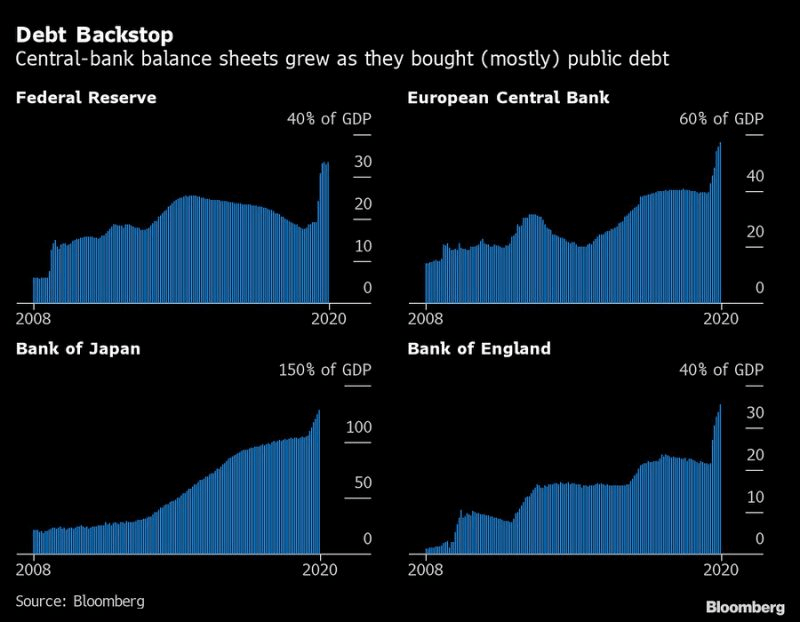

The fiscal rescue added 3.7 percentage points to global growth in 2020, according to JPMorgan Chase & Co. –- preventing the coronavirus rout from being roughly twice as bad. But JPMorgan economists expect that boost to turn into a drag next year, as stimulus gets choked off in a repeat of “policy missteps” that hobbled recoveries after the 2008 crash. Central banks have supported public spending by buying up swaths of the debt that governments issue. They typically insist bond purchases are aimed at pushing inflation up to target levels, and don’t amount to monetary financing of budget deficits.

The worry is that central bankers, who’ve often had to beat back political encroachments into their own monetary-policy turf, can put their independence at risk by straying outside it. But Fed officials are driven by awareness that they’re short of ammunition, according to Bill Dudley, head of the New York Fed for a decade through 2018. “They are reaching diminishing returns in terms of how their tools affect the economy,” said Dudley, now a scholar at Princeton. “It’s not that they can’t do more, but doing more wouldn’t do much. That’s precisely why they are talking about the need for fiscal policy.”

Global Central Bankers Say It’s Too Early to Stop Virus Spending, Bloomberg, Oct 14