Germany’s multi-year stagnation

August 27, 2024 @ 17:16 +03:00

Market picture

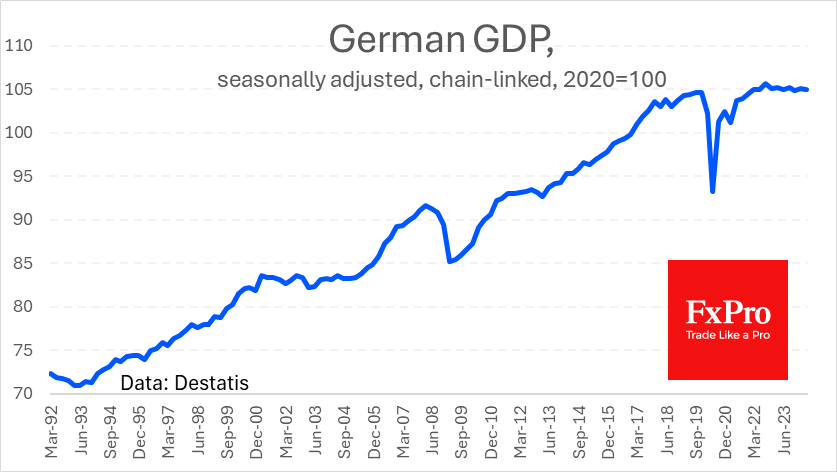

The final reading confirmed a 0.1% contraction in the German economy in the second quarter, with a modest growth of 0.3% y/y and stagnation close to the same level of March 2022, just 0.3% above the 2019 peak vs 9.3% in the US over the same period.

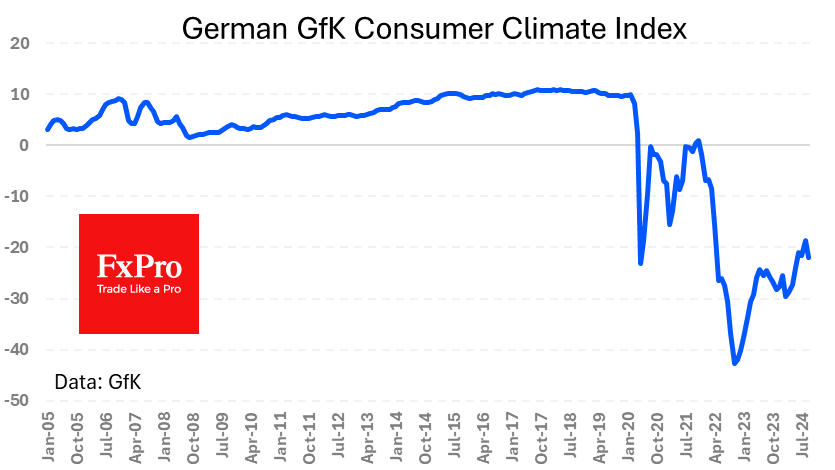

The unpleasant surprise came from GfK’s assessment of the consumer climate, which showed a marked decline in September after six months of smooth growth. Deteriorating economic expectations and incomes, as well as a decline in the propensity to buy, dragged the index down. The company attributes the enthusiasm of the previous six months to the European Football Championship in Germany.

Impact on the Euro

Weak macroeconomic data from Germany negatively impact the Euro, not so much due to the size of the country’s economy, but because the Bundesbank is suppressing its traditionally hawkish stance on inflation. Put simply, German weakness could dramatically accelerate ECB rate cuts.

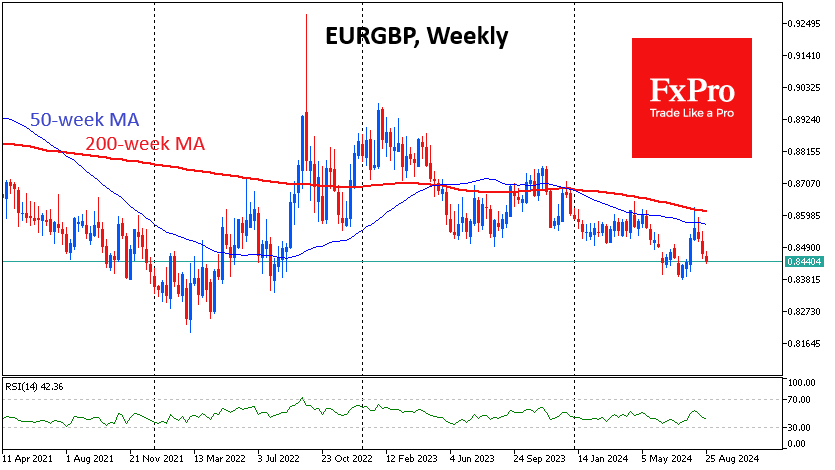

The flow of negative news has had less of an impact on the EURUSD due to the weakness of the US currency but is clearly visible in the pairing against the Pound. The EURGBP has lost around 2.2% in almost three weeks of declines, quickly returning to two-year lows after a rapid rise against the trend.

The FxPro Analyst Team