Geopolitics raises risk premiums, supporting Brent

February 17, 2026 @ 14:45 +03:00

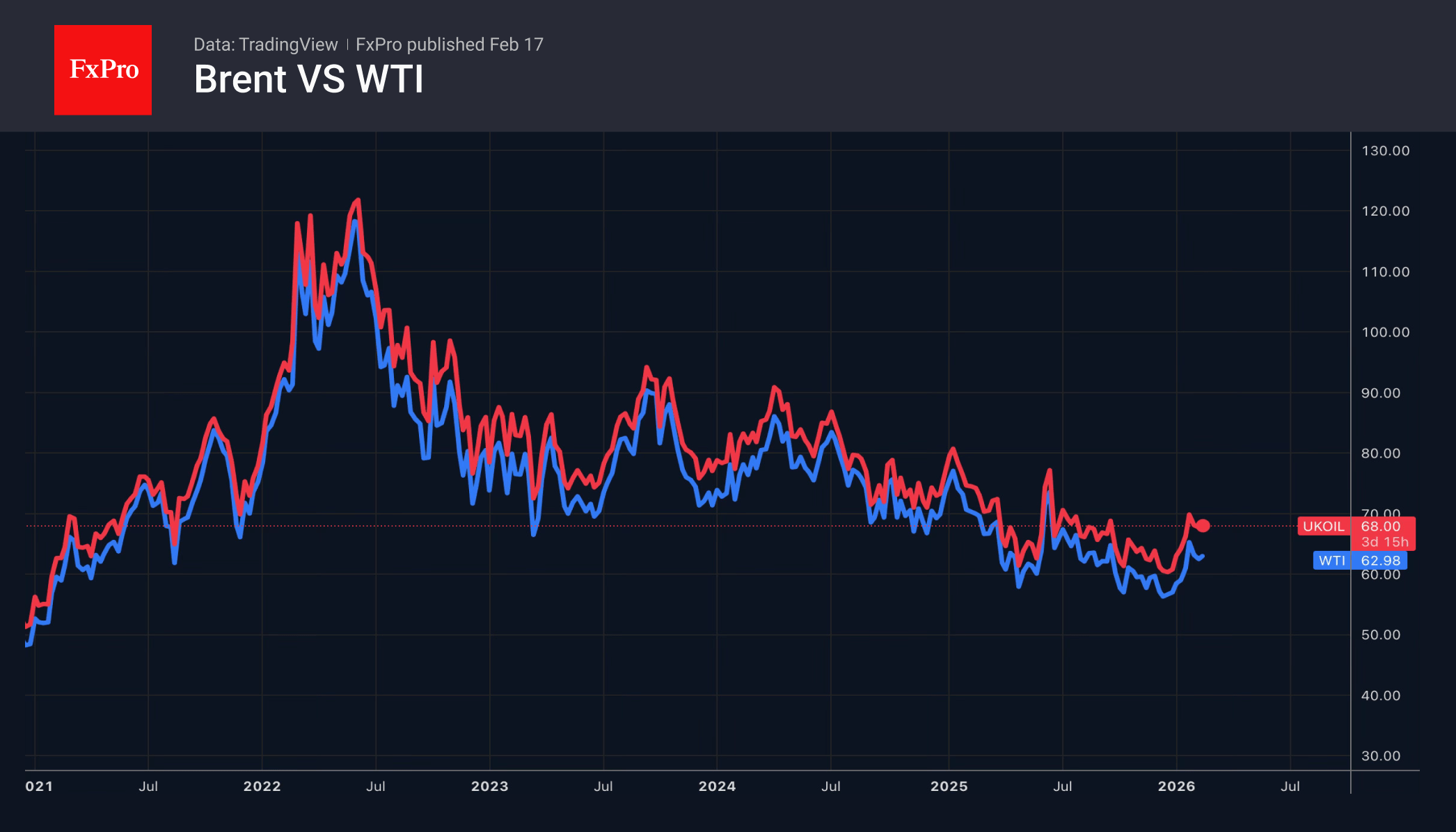

During crises and turmoil in the global economy or politics, market sentiment outweighs fundamental factors. Geopolitical risk premiums are currently estimated at $5-7 per barrel. At the same time, negotiations between the US and Iran, and between Russia and Ukraine, are the main drivers of oil market pricing.

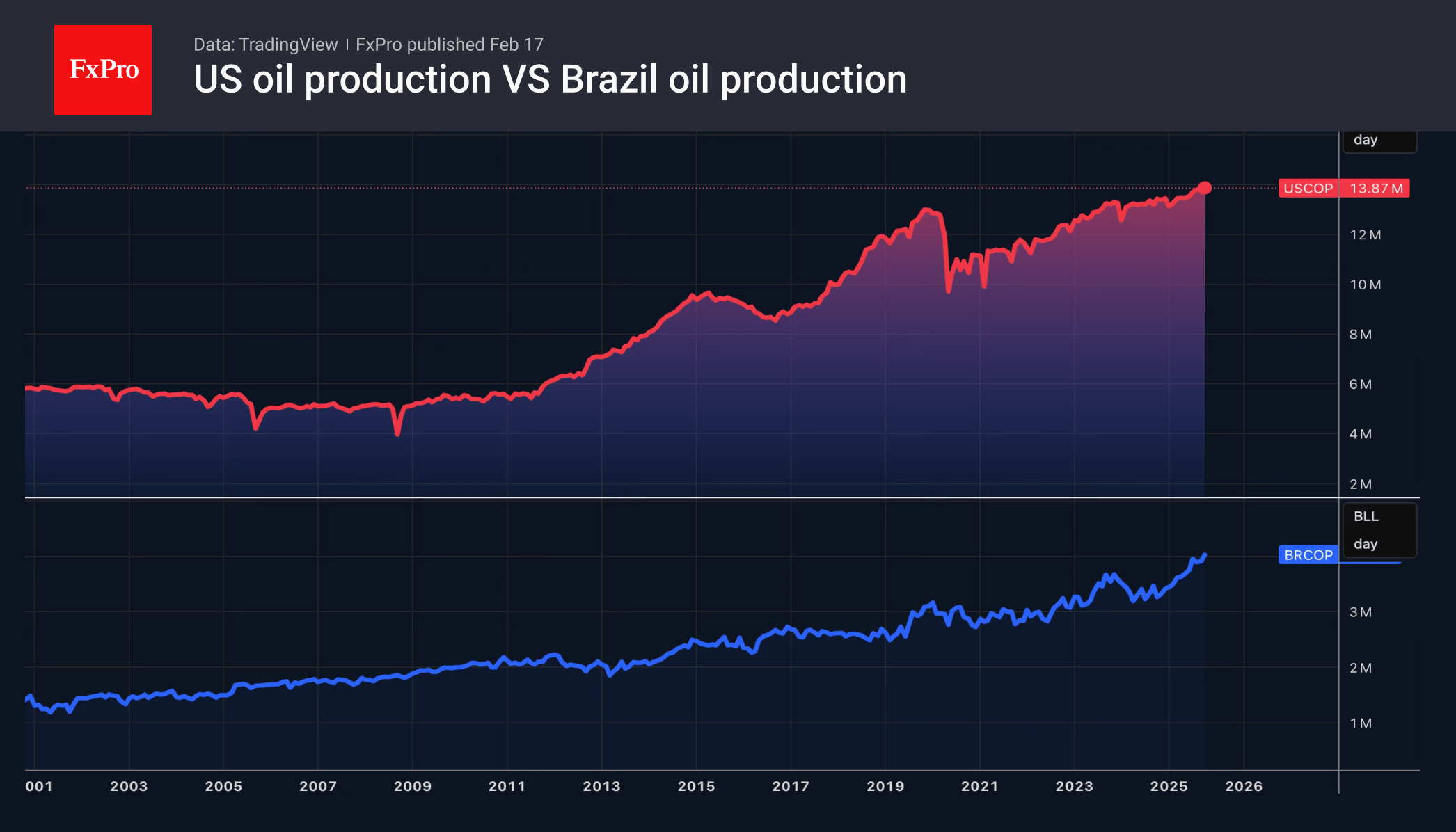

Over the past two years, the supply of black gold has consistently exceeded demand. As a result, according to estimates by the International Energy Agency, global reserves grew by a record 477 million barrels in 2025 due to increased production in the US, Brazil, OPEC+ and other countries. This is equivalent to 1.3 million barrels per day, which has led to a bear market for Brent and WTI.

Traders now have two questions on their agenda. The first is whether the conflict in the Middle East will destroy the global economy, as it did 50 years ago, and the second is whether Russia and Ukraine’s unwillingness to conclude a peace deal exacerbates existing supply problems.

In Bloomberg’s shock potential scenario, Brent soars to $108 per barrel amid Iran’s closure of the Strait of Hormuz. Tehran has launched military exercises in response to Donald Trump’s statement that the best-case scenario would be a change of power in the country. Tighter sanctions against Russia are prompting buyers of its oil, including India, to look for alternatives elsewhere. Increased demand for other types of oil is driving up prices.

At least three Reuters sources in OPEC+ claim that the group is ready to take advantage of the favourable market conditions for Crude and start increasing production in April after a pause in the first quarter. Kpler expects the remaining voluntary production cuts of 1.66 million barrels per day to be eliminated within six months. If so, OPEC+ has chosen the right time.

In Citi’s base scenario, deals between the countries will be concluded by the summer. Until then, Brent will continue to trade in the $65-70 per barrel range. After the geopolitical risk premium declines, bearish fundamentals will pull North Sea crude down to $60 to $62.

The FxPro Analyst Team