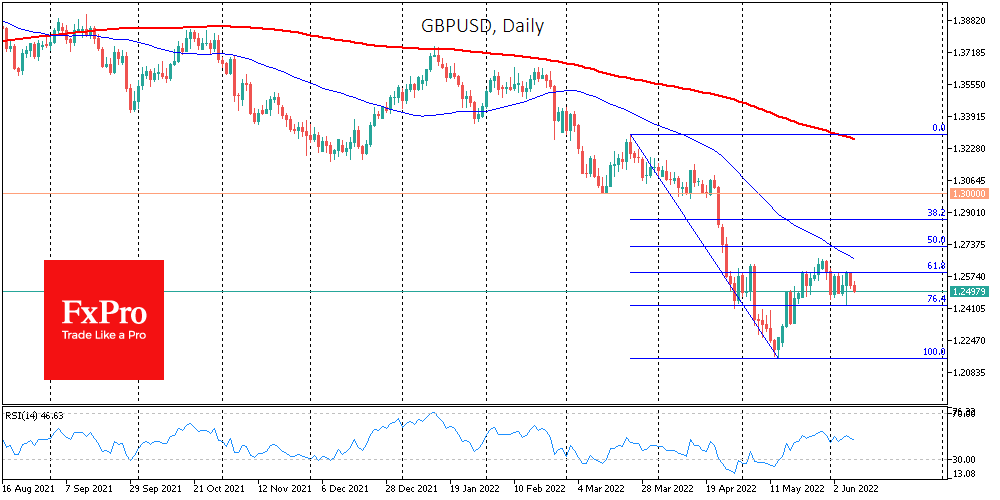

GBPUSD has lost its recovery momentum. How low can it go?

June 09, 2022 @ 11:31 +03:00

The British Pound is retreating for a second day, returning below the 1.25 level, failing to build on the positive momentum at the start of the week.

The pressure appears to be driven by rising government bond yields in global markets, starting with but not limited to the US.

The intraday dynamics of GBPUSD show methodical intraday selling. This is another sign of the rebound’s local exhaustion, and we might expect a new round of declines later.

A pullback of the FTSE100 from the local highs above 7600 is also working against the Pound. The British currency often has a positive correlation to the demand for risks, and its reduction contributes to selling the Pound in forex.

The final point of a new move down could be the 1.1500 area – near the March 2020 low. But before directing the pair to these historical levels, the bears have yet to prove their strength. The first test of the sellers’ intentions may be in this week’s low, at 1.2430.

Should it fail below May’s low at 1.2150, there may be a more meaningful signal. The GBPUSD could make its first move today in case of a sell-off in the equity markets. A move to test 1.2150 could take a couple of weeks.

The FxPro Analyst Team