FxPro: Weak PMIs put pressure on EUR

January 24, 2019 @ 16:52 +03:00

Eurozone PMI estimates put pressure on the single currency on Thursday. EURUSD experienced serious pressure, falling 0.5% to 1.1330 after the release of disappointing PMI estimates.

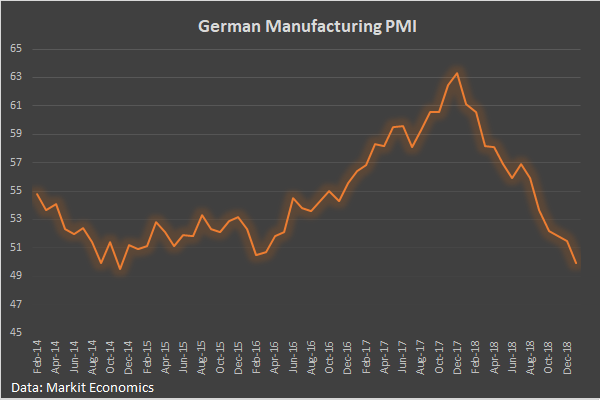

According to PMI, the manufacturing sector in Germany, which is the locomotive of the eurozone, is set to decline in January, as the indicator dropped to 49.9, while the 50 mark separates growth from decline. The service sector, on the contrary, has increased growth, but this case looks more like an exception. The euro zone continues to slow, and growth rates are close to stagnation.

Eurozone economic growth has been losing strength throughout the past year, but this did not stop the ECB from cutting the QE program.

Now market participants are focused on the comments related to ECB future policy. The ECB’s mandate is to keep inflation close to 2%, but economic growth slowdown suppresses inflation. Moreover, the sharp oil and other raw materials prices decline at the end of last year puts additional pressure on inflation.

The ECB promises to keep rates unchanged at least until the autumn of the next year in its comments. Formally, this is not an obligation to raise the rate in the fall, but the markets have tuned exactly to this scenario. The weak data releases may push the ECB to even softer rhetoric, moving the deadlines for promises to keep policy unchanged.

Alexander Kuptsikevich, the FxPro analyst