FxPro: Weak employment report broke dollar’s growth trend

December 10, 2018 @ 12:12 +03:00

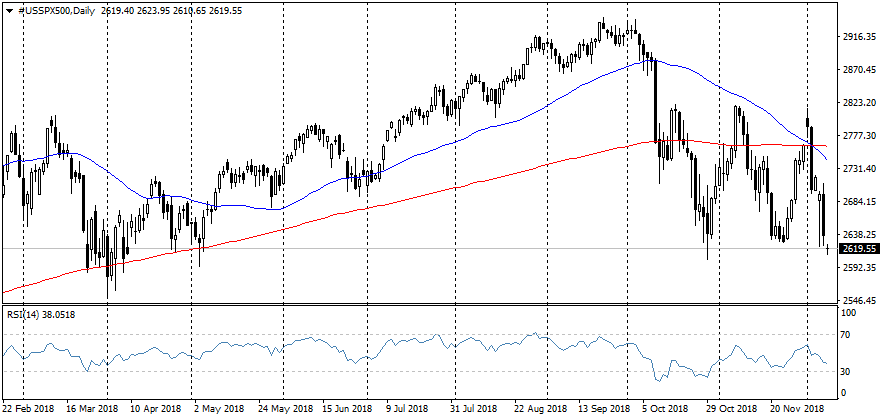

World markets are starting a new week with a decline. Futures on American S&P500 sank to levels where they have not steadily been since May. Shanghai’s Stock Exchange Blue chip index A50 slid to the lows of June-November. Japanese Nikkei225 sank to its local minimums.

Market reaction to weak statistics has added to anxiety around the trade wars between China and the United States. Poor macroeconomic data published by the three world’s largest economies exacerbated fears around the pace of global growth.

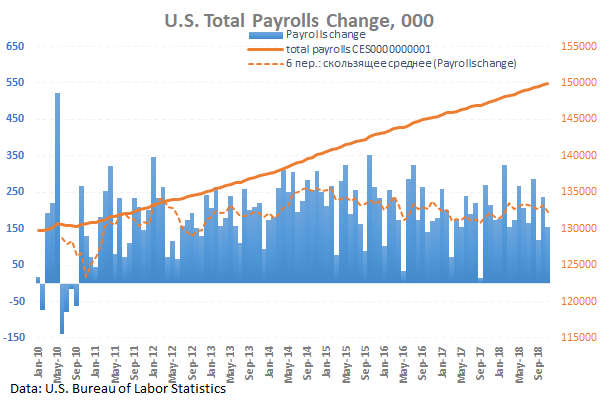

U.S. labor market were significantly worse than expected (growth by 155K new jobs against the expected 200K), causing both weakening of the dollar and the fall of the U.S. stock indices. Dollar decline very often helps markets. But this time, investors preferred to temporarily stay away from American assets.

The U.S. labor market’s sudden weakness pulled the dollar out of the growth trend that last since the end of September and is trading now at the level of 96.40 on the dollar index DXY, retreating below 1.1430 for the euro in a pair of EURUSD. The final scrapping of the dollar growth trend will confirm the capture of the previous local extremes on 96.0 and 1.1450, respectively.

In our view, the dollar’s retreat is unlikely to be sustainable. The weakening of the United States is rapidly being moved to other markets and economies. Against the backdrop of weaker indicators and missed expectations in other countries, the dollar may soon receive support as a safe-haven currency.

Thus, the dollar is more likely to wait for another period of consolidation in the range, rather than experienced a full downward reversal. Similar periods of consolidation earlier this year were observed from January to April and from May to September, while markets waited for further signals from economic indicators and central banks reactions to them.

However, this time there are more signs of fading growth in key regions.

On Sunday it became known that consumer inflation in China slowed from 2.5% to 2.2% yoy and for Producer prices Index from 3.3% to 2.7% yoy. Both indicators came out worse than expected, despite yuan lost about 10% since the middle of the year. All of it indicates a sharp slowdown in the economy, where domestic demand cannot overcome the problems caused by trade conflicts.

The final data on Japan’s GDP on Monday morning noted a contraction of the economy by 0.6% in 3Q, the strongest in four years. In addition, in November, we observed a slowdown in the level of lending, which is another sign of problems with economic growth.