FxPro: Timid markets growth and important levels for S&P500

October 12, 2018 @ 11:12 +03:00

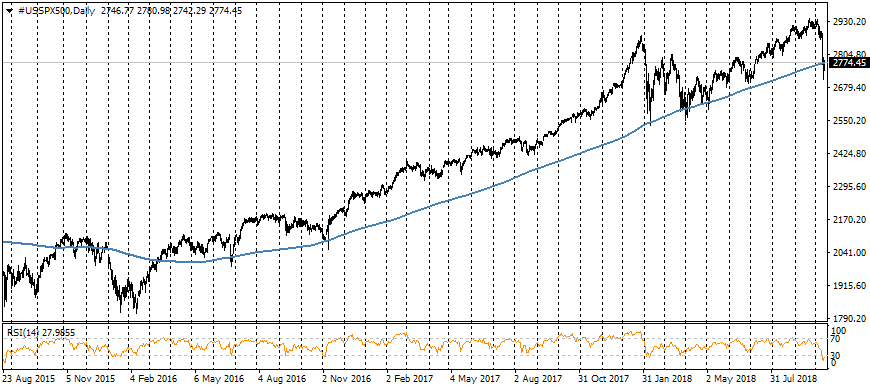

On Friday morning, the markets seem calmed after a rough sale of the previous days. American S&P500 decreased by 2.1% on Thursday , but the futures for the index has added 0.6% since the beginning of the day. The index fell below of 200-day average line on Thursday and tries to climb higher this morning.

The market has repeatedly received support on approaching this mark for the last two and a half years. However, in 2018, corrective kickbacks to this line became more frequent, reflecting the uncertainty of market participants in the future prospects of the stock rate growth. The fixation below this line is often considered as a signal of prolonged correction, as it was in the middle of 2015 and early 2016.

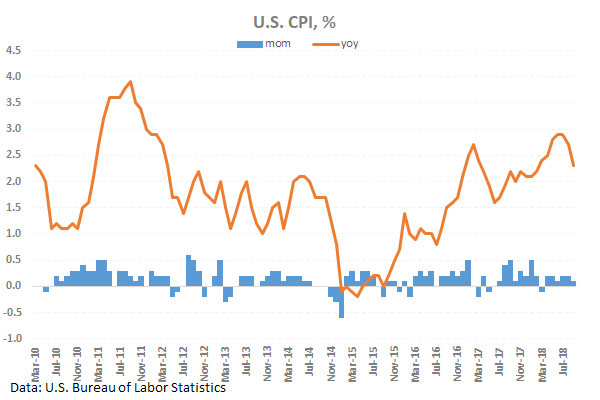

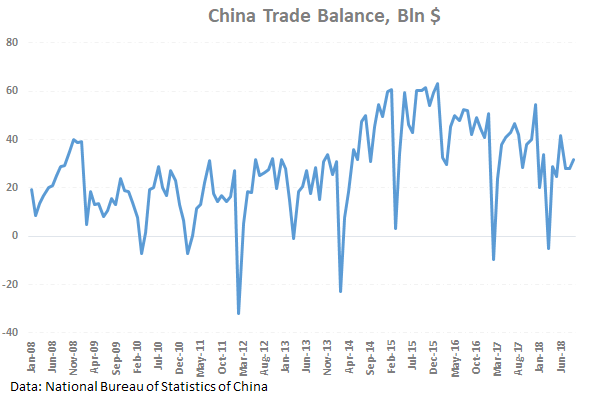

Chinese markets show some rebound after a multi-day recession. China’s blue-chip shares has bounced off the support area for 10800 the fourth time since July. Heng Seng also adds this morning, bouncing off the 17-month lows. The US inflation data published on Thursday slows down the sale of the markets, and China’s strong trade statistics became an important reason for the resumption of purchases on Friday.

The consumer inflation in the US slowed down to an annual rate of 2.3% in September against the peak 2.9% in July. The return of the inflation closer to the target 2% of the Fed somewhat lowered the fears of market participants that the US central bank would accelerate the rate hikes, suppressing economic growth. This data caused a further weakening of the dollar, which in turn reduces the pressure on global markets.

China has increased the surplus in trade markedly above expectations, and the surplus balance with the US has proved to be a record, despite the tariffs, which has already been imposed. The main driver of growth became the fears that trade conflicts would only intensify, which prompted exporters to hurry up with the shipment. At the same time, the surplus above expectations reduces fears around the hard landing of China’s economy.