FxPro: The Fed’s patience is not enough anymore to stop EURUSD decline

February 07, 2019 @ 16:30 +03:00

Despite the fact that the report on the US labour market did not cause a powerful wave of dollar purchases, it still spawned a trend to strengthen against most currencies. As we wrote after the release of labour market statistics, the US economy is not slowing as much as other regions of the world.

At the end of the year, the Fed launched a wave of the dollar weakening, clearly its rhetoric. This reversal was confirmed last week when the phrase about the need for further policy tightening was eliminated from the accompanying decision on the rate, which caused a violent sale of USD.

However, central banks in other countries are increasingly frequently copying the rhetoric of the Fed, or even moving to active steps to mitigate monetary conditions. So, this factor quickly got out of the equation. Now, with a great deal of confidence, it can be argued that this change has already been taken into account by the markets, and the incoming economic data will affect the rates.

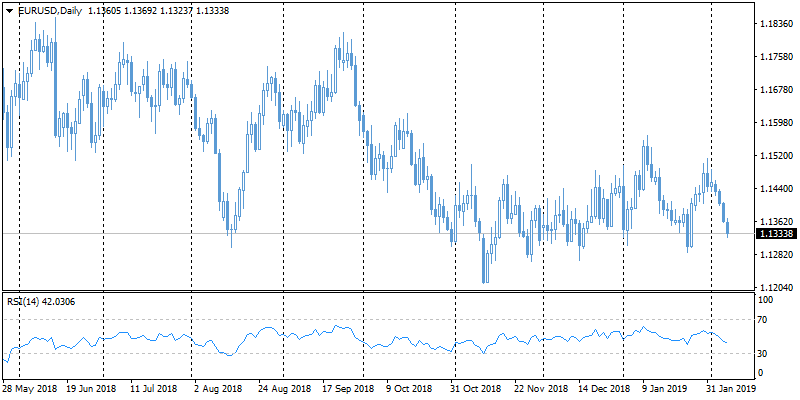

Published statistics are not as easily influenced as the rhetoric of central bankers. In this regard, the dollar growth momentum against the euro persists all the time until we see relatively stable data from the US in contrast with all the new signs of the growth slowdown in Europe.

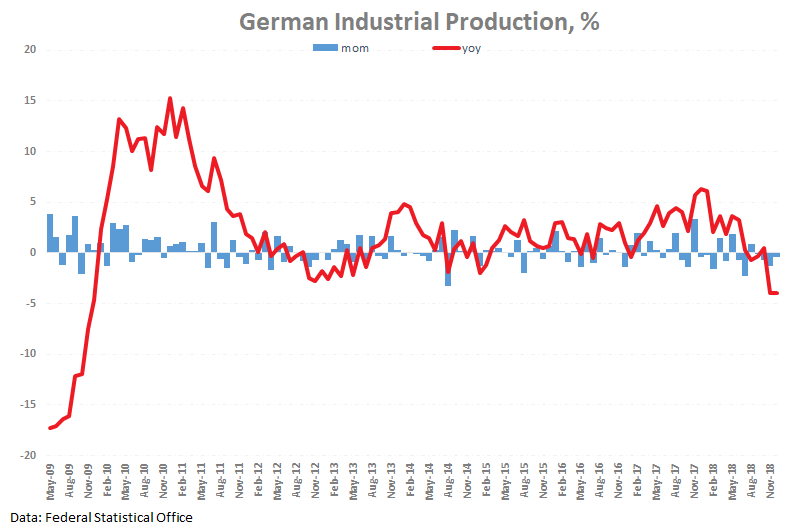

Today’s package of statistics from Europe has become another confirmation of the business activity downturn. German industrial production fell by 0.4% in December vs expected 0.8% growth. Against the last year, the decline is 3.9%. France’s trade balance, retail sales in Italy also showed a decline and were noticeably worse than expected.

Not surprisingly, after the publication of such data, the euro continued to decline against the dollar to an area of 2-week lows around 1.1340.

However, we cannot lose sight of data from the United States. Weekly applications for unemployment benefits have fluctuated dramatically lately: following a fall from 212K to 200K, there was a jump to 253K last week. This may be a sign of a reversal of the indicator to growth, which will cool the dollar buyers.

Alexander Kuptsikevich, the FxPro analyst