FxPro: The euro collapsed after the ECB extended an easy-money policy

March 07, 2019 @ 18:24 +03:00

The euro collapsed after the ECB warned it did not intend to consider a rate hike earlier than 2020, and also promised a new round of loans for banks at low interest rates. Earlier, the Bank promised that it would not raise the rate before the beginning of autumn 2019.

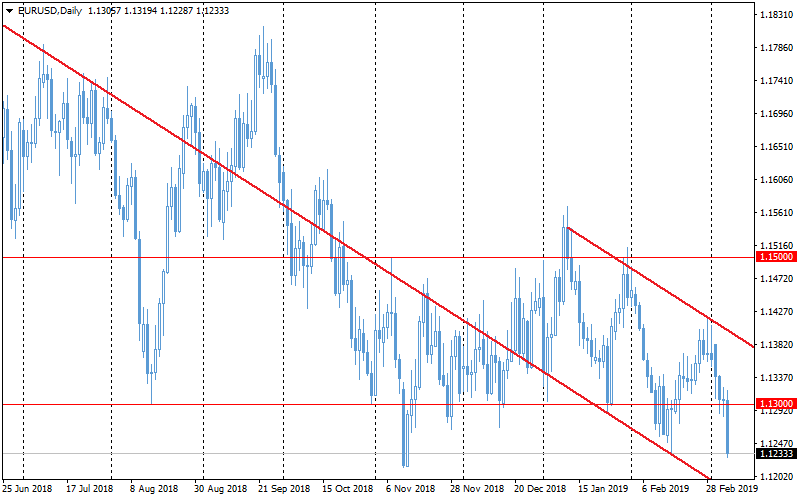

Despite the fact that this softening of rhetoric is in the common this time around for most of the major central banks, this shift was not fully embedded in the single currency and bond prices. As a result of this announcement, the single currency loses 0.8% against the dollar, dropping to 1.1230 in less than two hours.

The movement reinforces the fact that the euro has gone beyond the established trading range, and now the sale is fueled by an avalanche of triggered stop orders.

Current marks can safely be considered lows from mid-2017 since in mid-November last year the pair was trading below just 5 hours.

From the side of technical analysis, the closing of the day below 1.13 can be considered as going beyond the limits of the lateral trading range 1.13-1.15. Now the downward trend passing through the peak levels from January 10th can become the current model. The lower limit of this range now passes through 1.1180. In this case, the sale may slow down for some time near these levels.

Today’s strong euro/dollar reaction stole volatility from tomorrow’s payrolls. Participants usually place stop orders in advance slightly outside the established trading ranges. Most likely, after this avalanche of order triggering, tomorrow there may not be a strong market reaction.

Alexander Kuptsikevich, the FxPro analyst