FxPro: S&P 500 hits important resistance levels and heading all-time highs

March 18, 2019 @ 15:59 +03:00

US Market index overcome major resistance and set to growth on softer major Central Banks tone

Stock markets correction is over Equity markets are rising after the recovery of demand for risky assets. S&P 500 closed last week at the highs since October, finally convincing everyone of overcoming an important resistance at 2800 points. Shanghai blue-chip index China A50 rose 2.7% on Monday, closing at the highs area since April last year.

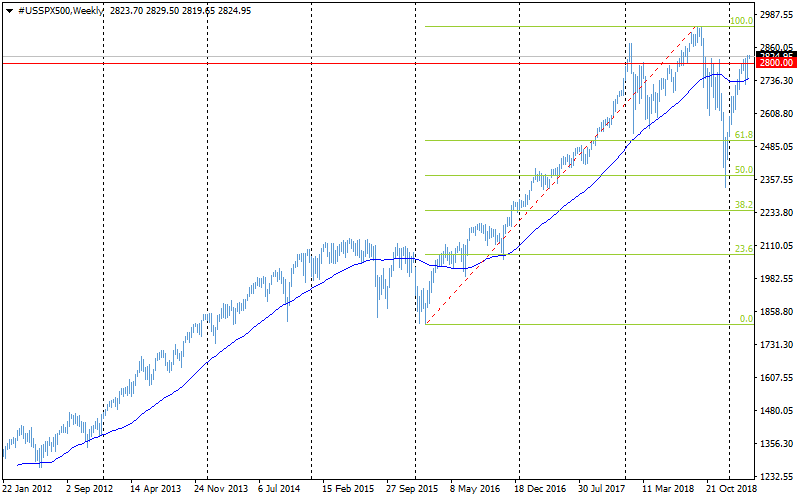

As for technical analysis, we are witnessing an almost perfect picture for future stock markets growth. The markets decline during October-December was a “Trump Rally” correction. This correction brought back the attractiveness of those stocks that were drivers of growth in previous years, but then looked a bit overvalued.

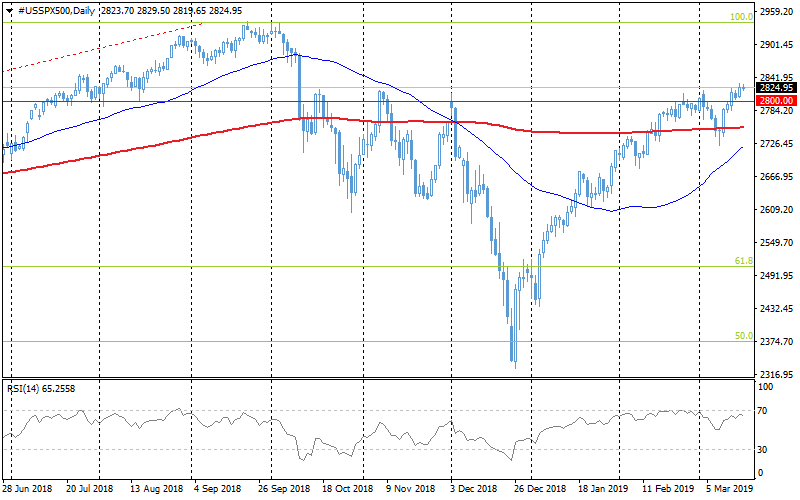

Room for growth The subsequent pullback since the end of last year was sharp, showing overbought levels on the daily charts. In early March, this overbought background turned into a decline, which, in turn, was also bought out. The first bell that the markets did not seriously consider the March decline, was that the markets quickly turned to growth after touching the 200-day moving average.

The second confirmation was the consolidation above 2800 – an important resistance level, from where the S&P 500 turned to decline four times since October.

It is also worth noting that the growth of US stock indices is still far from exhaustion, as the RSI remains in neutral territory.

The S&P 500 has overcome previous important levels of consolidations, and now it can be on the direct path to updating its highs at 2940, which is 4% higher than current levels.

The Fed, the ECB and the PBC rhetoric softening can be noted as the main market drivers. As in 2016, they managed to stop panic sales in the markets by mitigating rhetoric. Later this week, the next Fed meeting will take place, and markets are waiting for the soft rhetoric confirmation of the most important world central bankers, which additionally can breathe life into the demand in the stock markets.

Alexander Kuptsikevich, the FxPro analyst