FxPro: Payrolls and Powell can help markets to choose their direction

January 04, 2019 @ 12:49 +03:00

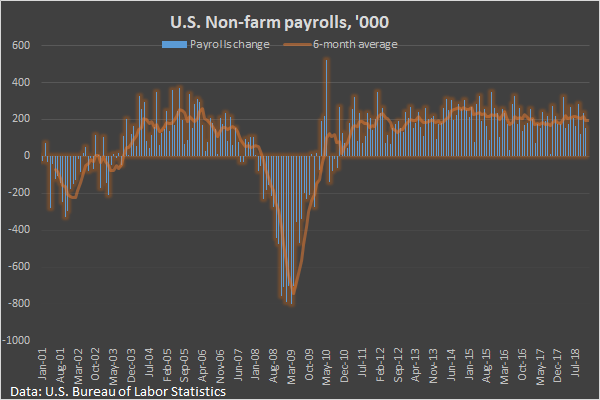

This Friday is the labor data day. We will see such data are coming out from Germany, Canada and the USA. The latest release is the most important for markets and can be decisive for American and global trading exchanges trends. In addition, Powell’s speech along with his two predecessors as head of the Fed additionally complicates situation after the statistics publication.

Within a few hours, markets can get both the reason and the formal confirmation of the Fed’s course change towards greater softness. Or, on the contrary, to say goodbye to hopes for Fed’s softer tone.

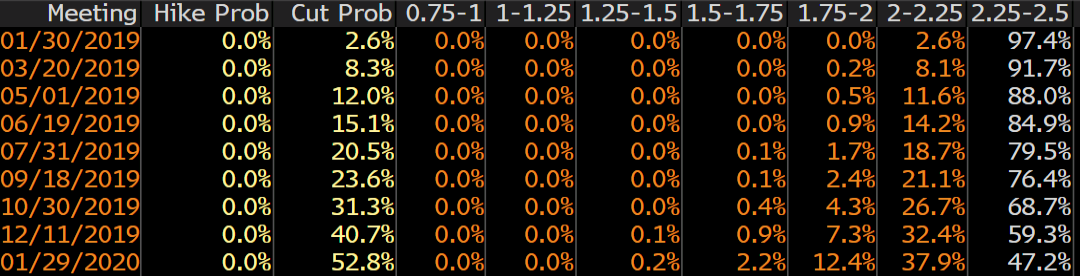

The sharp decline in the stock indices at the end of last year and strong demand for defensive assets led to the interest rate futures indicate a 40% probability of a rate cut in 2019, and more than 52% chances of that outcome by the end of 2020. This situation should not be considered as market forecasts, but as distortions caused by flee from stocks to more liquid and safe bonds due to holidays.

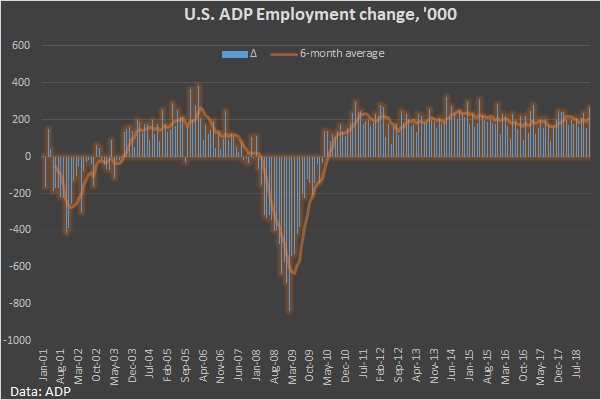

Recent days were marked by conflicting data releases, which is further reinforcing uncertainty before Employment report. According to ADP, Private sector employment grew by 271K in December, greatly exceeding expectations of 179K. Car sales in December remained high, as in general consumer spending. Housing market in recent weeks has pointed to a return to growth. All these factors should reduce markets fears before the negative impact of the interest rates growth on consumer spending.

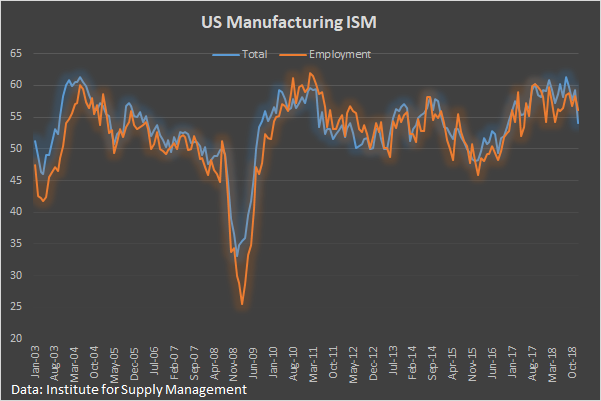

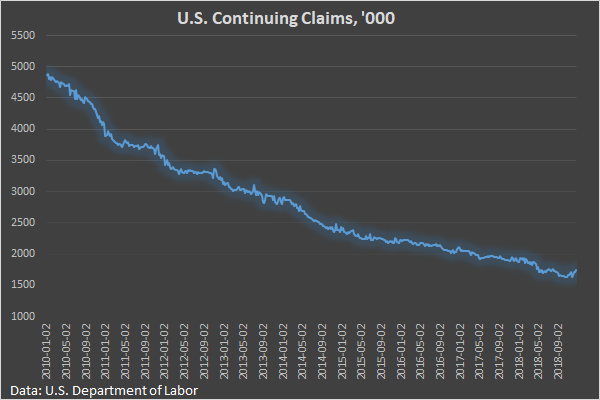

At the same time, markets are afraid of declining Apple revenue forecasts. Manufacturing PMI indexes from Markit and ISM were marked by a sharp fall to many months’ lows after price component decline. Unemployment claims have been increased in the last three weeks after drop in early December, and the number of Continued claims has risen to the highest level since July last year.

Thus, now there are enough evidences both to maintain a steady growth of the US economy, despite the increase in interest rates, and for a slowdown in the economy. Such different perspectives leave a wide space for forecasts and can provoke sharp USD fluctuations in one or the other direction within a couple of hours.

Alexander Kuptsikevich, the FxPro analyst