FxPro: Markets don’t believe Fed any more

March 25, 2019 @ 14:28 +03:00

On Friday, stock markets experienced one of the biggest declines this year, losing almost 2% on the S&P 500. Investors were frightened by the debt markets signals as the yield on 10-year US government bonds sank lower than the 3-month yield for the first time since 2007. The normal considered when as the higher yield for bonds with a longer maturity.

The opposite situation is regarded as a signal of the coming recession when interest rates are traditionally lower. In our opinion, the markets are somewhat confused about what is the cause and what is the consequence.

The cautious tone of the largest regulators undoubtedly provokes market anxiety and initially puts pressure on stock prices. However, the fact that central banks are taking proactive actions to calm the markets ultimately can bring growth back to the markets.

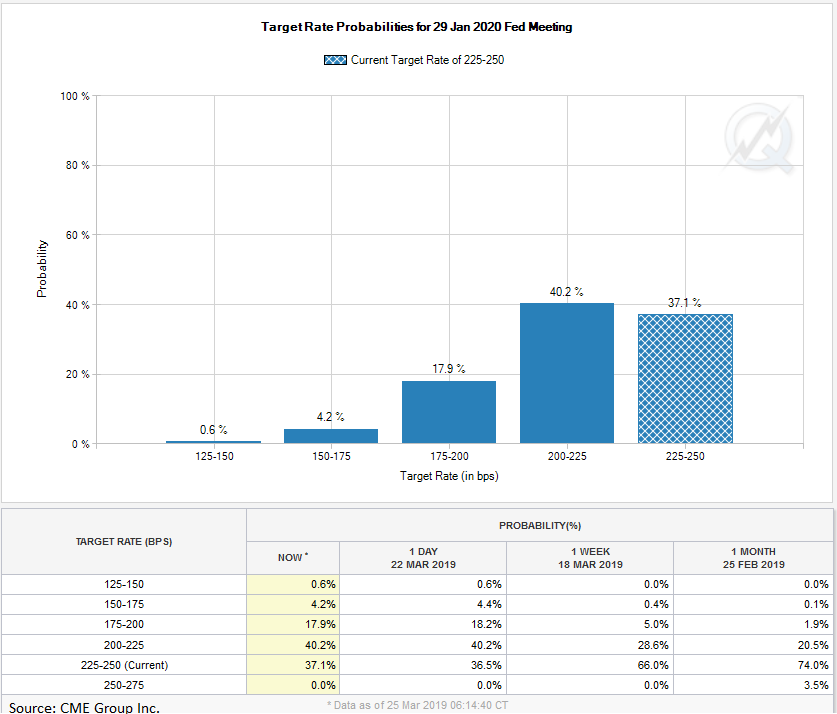

The yield declined due to a softer Fed tone. Markets now estimate the chances of lowering rates at 68% in the coming year compared to 22.5% a month earlier. But this sharply contradicts the forecasts of the Fed itself, which does not expect rate changes in the coming year.

In other words, the Fed is not tightening policy now to avoid a sharp reduction of rates in the future and not to pull the economy out of recession. In 2016, a similar pause on the way of tightening was enough to put the United States back on the path of growth and even demonstrate impressive acceleration. The same applies to the ECB, Bank of Japan and the Central Bank of China. Apparently, they are now trying to repeat the trick that worked three years ago.

As usual in the economy, it is impossible to avoid “if” and “but”. It may well be that the increase in the number of problems may require a more structural solution than just a pause in raising of interest rates. Such fears still look premature, but still, it is better to keep them under control.

In the short term, in our opinion, the chances are higher that markets will accept the Fed’s softness and lower long-term rates as a source for growth, but not cause for concerns. Potentially, lower interest rates can fuel demand for risky assets after the initial shock passes through financial markets.

Alexander Kuptsikevich, the FxPro analyst