FxPro: Fed may determine whether EURUSD heading to 1.11 or 1.15

March 19, 2019 @ 16:52 +03:00

EURUSD has reached the resistance of the downward channel before the important Fed meeting, which is able to determine the further trend

The single currency is growing against the dollar for seven trading sessions out of the last eight, quickly recovering from a 20-month low against the dollar from 1.1180 to 1.1350 at the moment.

We recall that the EUR decline against the USD was triggered by a sharp deterioration in forecasts and a significant easing of rhetoric following the meeting in early March when the ECB promised not to raise the rate in 2019 and promised new round of LTRO auctions. In theory, such a move by the ECB was a response to easing the Fed’s rhetoric.

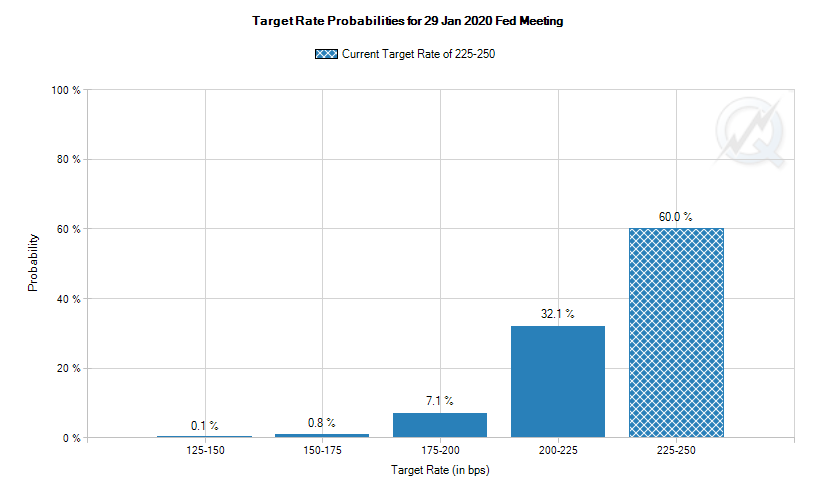

An initiative is on the FED side Nevertheless, the initiative is now on the side of the American Central Bank, which will publish on Wednesday its forecasts of economic growth and expectations for changes in interest rates in 2019. Markets are currently forecasting the preservation of extremely stimulating rhetoric. The CME’s FedWatch tool indicates that market participants are giving a 38% chance of lowering rates over the next 12 months, which is in sharp contrast to the latest official estimate of 1-2 hikes in 2019. Markets very often adhere to softer forecasts than the FOMC at the beginning of the year, but then adjust them not without the help of the Fed politicians.

Fed: master or slave? The March meeting may be another attempt to push the markets to adjust their expectations related to the Fed extreme dovish policy, as recent data from the US is not as bad as market participants feared, and this well underlines the stock markets extremely optimistic mood.

If we are right, EURUSD may turn to decline after touching the resistance of the downward channel near 1.1350 which will send the pair to a new wave of decline. Technical target for this decline could be the area of the previous local lows around 1.1180. The lower limit of the current descending channel passes through the 1.1100 marks by the end of March and may become a level of attraction for the bears in the event of a dollar turning towards growth.

It would not be wise to completely eliminate the alternative scenario. The Fed regularly finds itself under a barrage of criticism from Trump, and therefore may well succumb to pressure and take another round of softening of the rhetoric. Under these conditions, the EURUSD pair can break out of the downward channel. Strong impulse above 1.1350 can be a starting point for growth to levels above 1.1500, returning the pair to the side range.

Alexander Kuptsikevich, the FxPro analyst