FxPro Daily Insight for March 4

March 04, 2020 @ 17:46 +03:00

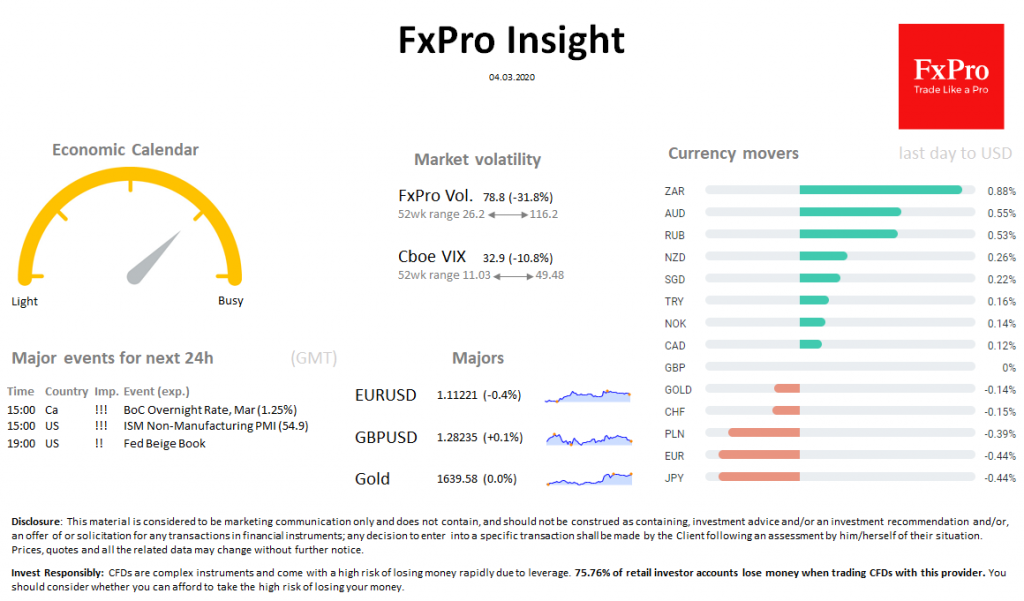

Market overview Market volatility declined after sharp jumps in both directions over the previous two weeks. Fed rate cuts and market guesses that more to come from other Central Banks, feed cautious demand for risky assets, supporting stock indices: futures for S&P500 + 2.0%, FTSE100 + 1.5%, Dax + 1.4%.

The dollar returned to growth, as expectations swayed to easing from other Central Banks after the Fed.

The leaders in the growth to USD are the commodities ZAR, AUD, RUB. JPY, EUR, CHF lose on restoring risk appetite.

Gold stabilized near $1640, after a 4% jump on Tuesday.

Brent is trading at $ 52.8, receiving buyers support on dips to $51.00 for the second day. Quotes froze in anticipation of signals from the OPEC+ meeting in the coming days and the publication of US inventories data.

Important events, GMT (Exp.): 15:00 Ca !!! BoC Overnight Rate, Mar (1.25%) 15:00 US !!! ISM Non-Manufacturing PMI (54.9) 19:00 US !! Fed Beige Book