FxPro Daily Insight for February 20

February 20, 2020 @ 16:53 +03:00

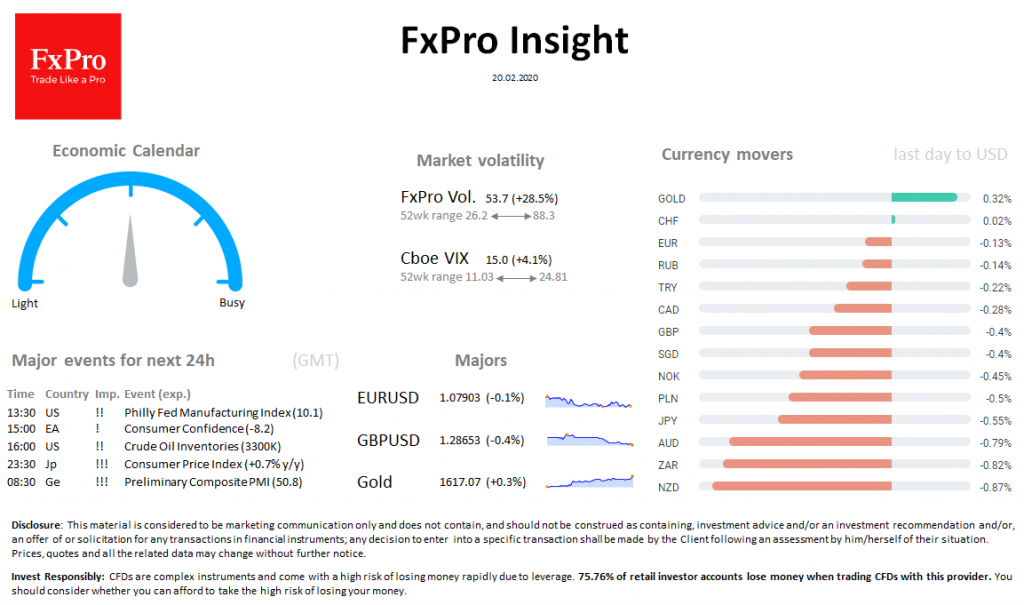

Market overview European and US indices recede from the highs reached overnight. Nasdaq added 7.7% this month, jumping from the levels near 9000 to 9700 and to just a couple of steps from the critical 10000 milestone.

In the FX, the dollar continues and widens its rally against major currencies. DXY has been adding 0.3% today, reaching 99.80, the highest level since April 2017. USDJPY continues to fly upward, breaking 112.00 to the highs of 2019. AUDUSD crashed to 0.6620, pulling the NZDUSD’s selloff.

In the UK, retail sales were above expectations (0.8% y/y versus 0.6% y/y expected), it failed to keep the Pound from weakening below 1.2970 – the lows since November. Among macro data, attention is now on US oil inventories and the release of preliminary PMIs for eurozone countries on Friday morning.

Oil growth stalled at $59 per barrel of Brent and $ 53 at WTI – near Wednesday’s closing levels.

Gold rally continues, bringing the price of a troy ounce to $ 1,617 – a seven years highs.

Important events, GMT (Exp.): 13:30 US !! Philly Fed Manufacturing Index (10.1) 15:00 EA ! Consumer Confidence (-8.2) 16:00 US !! Crude Oil Inventories (3300K) 23:30 Jp !!! Consumer Price Index (+0.7% y/y) 08:30 Ge !!! Preliminary Composite PMI (50.8)