FxPro: Bond and Forex markets signal about a possible reversal in stocks

November 22, 2018 @ 11:13 +03:00

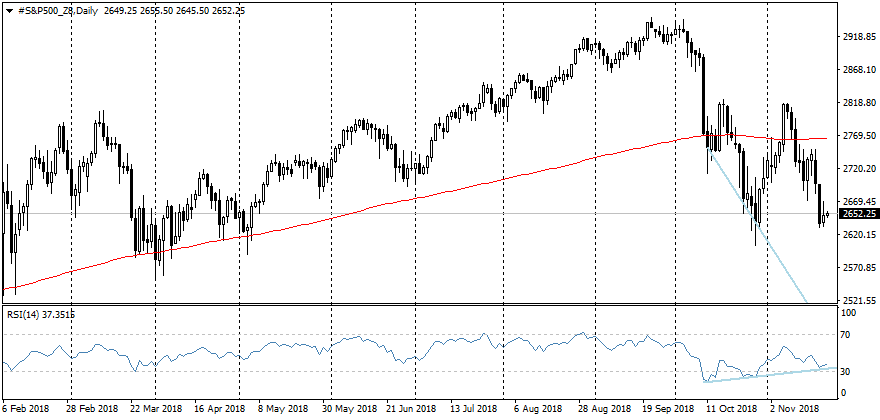

Markets diligently tried to defend their positions before the holidays in the USA. American indices had completed the trading on Wednesday almost unchanged, after losing about 4% in first two days of the week. The stocks of the energy sector companies had bounced off by 1-2% following the oil after a 6% plunge in the previous day.

American markets are closed on Thursday, and on Friday there is going to be a shortened trading session with a significant part of the players staying away from the trading. This had reinforced the focus on the trading dynamics in the first half of the week.

As we have noted earlier, despite the negative dynamics of the market favorites in previous months and years, market participants are far from panic. Index VIX has been traded near 20 for about a month, keeping its position despite the decline in shares.

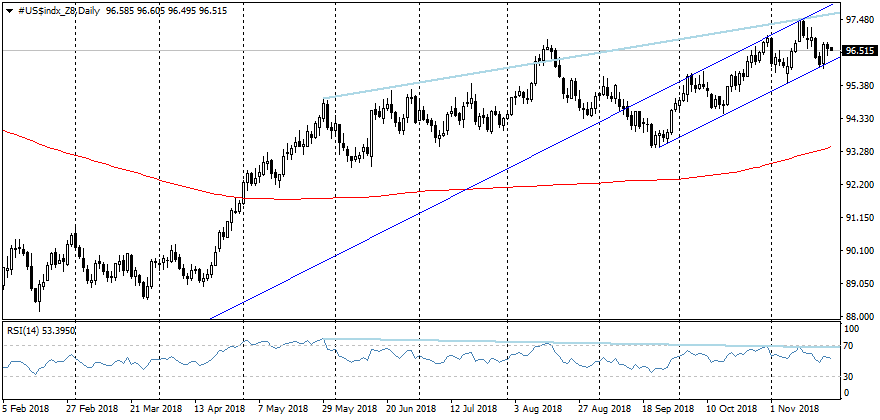

The easing of the Fed’s rhetoric last week has turned the dollar into decline, although this has not yet much affected the stock prices. The traders with shares are still afraid of possible problems with sales of the Apple stocks and are concerned about the exhaustion of the overall effect of tax reform on the economic growth.

The foreign exchange market is often the first to react on the changes in external conditions. And it has already given its verdict to the Fed’s sentiment, throwing away the dollar from the multi-month highs. The development of this trend will soften the market’s financial conditions, strengthening support for the shares.

Moreover, the yield of the U.S. government bonds has been declining over the past two weeks. The yield of 10-years U.S. Treasuries had decreased from 3.25% to 3.06%. If at the initial stage this could be attributed to an increased demand for protective assets and was under the accompaniment of the dollar growth, the further yield decline (price growth) last week has related to the revision of the Fed’s policy expectations. Now it does not sound so unequivocally hawkish as in the start of October and that is also able to return the demand for stocks if this trend proves to be sustainable.

Following the decline in yield on the US debt market, the effect should soon emerge, which can seriously change the investor’s mood. Especially if the risks of the expanding trade wars and a sharp slowdown of the economy are not realized.