FX majors and Dow Jones are close to important milestones

February 06, 2020 @ 12:28 +03:00

Major FX currency pairs, as well as the American Dow Jones index, are now close to decisive round levels. Their overcoming depends on the market reaction to Friday’s NFPs.

All three major American indices have updated their historical highs, adding more than 1% on Wednesday. Futures on the index are growing on Thursday morning after another portion of good news. Here are just a few of them: the spreading of coronavirus has slowed sharply, Chinese doctors reported a breakthrough in vaccine development, extremely positive news on the US labour market in January and China announced that it will halve tariffs on 1717 US import products.

Shanghai’s China A50 blue-chip index won back 70% of the decline after markets opened on Monday. The U.S. Dow Jones added by more than 1.5% on Tuesday and Wednesday and is trading close to 29500 this morning, adding 1300 points this week. With such bull run, 30K level may be taken as early as this week, attracting additional interest from market participants and spreading the positive vibes to other markets.

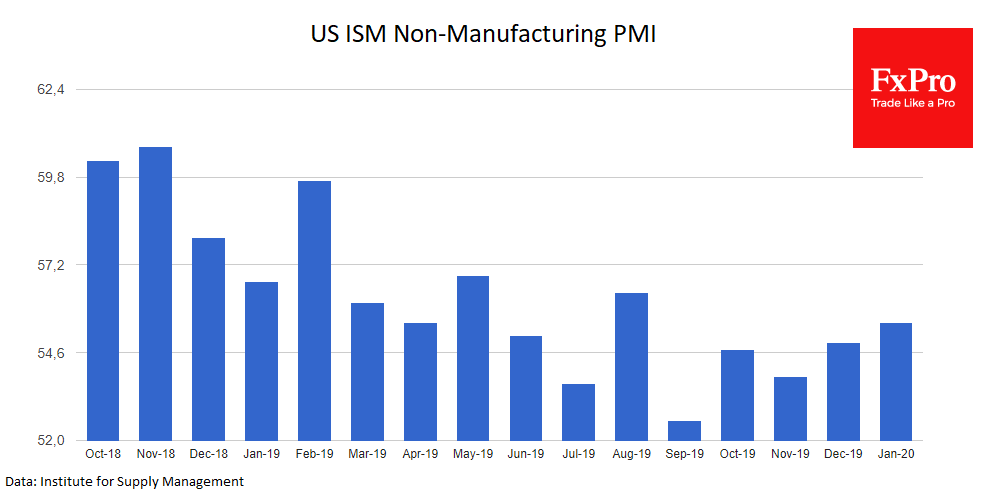

This growth of stock indices must not be connected with expectations of policy easing. Purchases strengthened on the back of solid employment data from ADP, which showed the jobs increase by 291k in January. A little later, the positive agenda was supported by higher than expected activity of indices in the service sector. Both Markit and ISM estimates unanimously show stronger growth since September-October, responding to lower rates and liquidity injections from the Fed and trade talks progress.

Strong statistics caused markets to reassess the chances of new policy easing from the Fed. This turn in expectations supported the dollar, which added 0.9% against the basket of six major currencies to the two months highs. The key currency pairs approached the critical round levels, too.

EURUSD declined to 1.1000, to area where it received the buyers’ support since November. The publication of Friday’s statistics may confirm or weaken this trend. Healthy US data is likely to bring back into the market focus the bright contrast between the US and Europe growth in favour of the former.

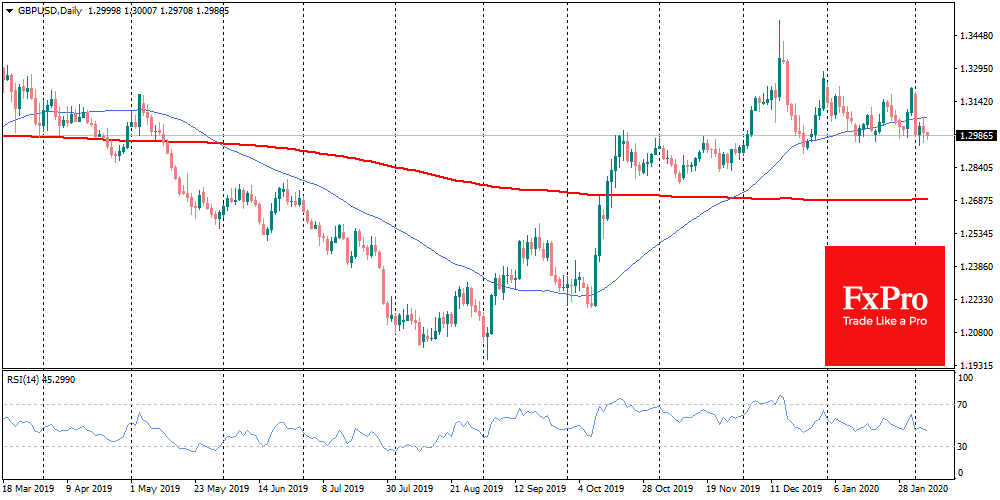

The same goes for GBPUSD. The British pound slipped below 1.3000, a kind of waterline of the last three years. The pair traded lower THAN this level during the periods of investors’ anxiety for the economy after Brexit.

USDJPY is testing 110, another crucial round level, as the outcome of the struggle for it may be decisive for the trend of the next days and even months.

The FxPro Analyst Team