Food prices are breaking multi-year highs, and the CBs are helpless

February 25, 2022 @ 13:39 +03:00

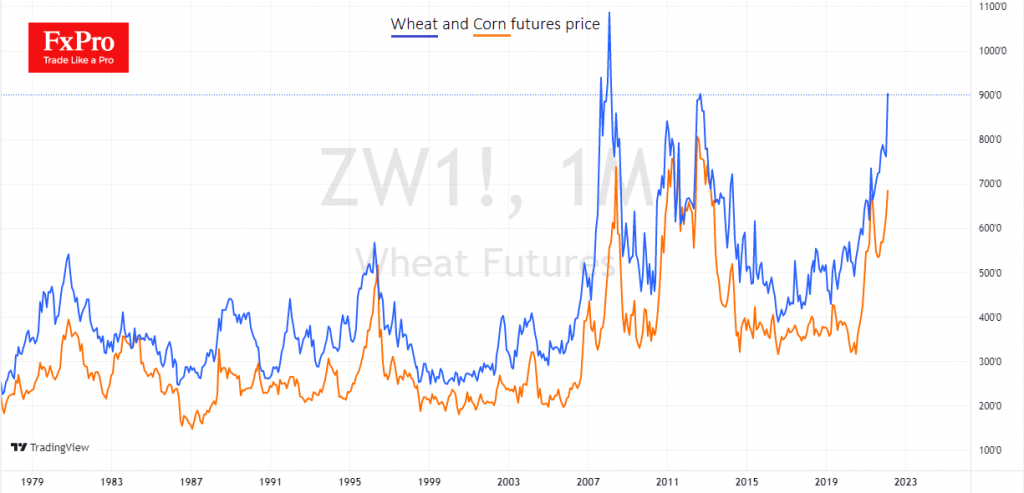

Wheat futures on the CBOE are up 16% since the start of the week, the biggest rally since the poor harvest in 2012. At one point yesterday, the weekly rise was close to 20%. The price level was the highest since April 2008, as traders anxiously assessed the impact of the conflict between two of the world’s biggest exporters of wheat, corn, and other agricultural products.

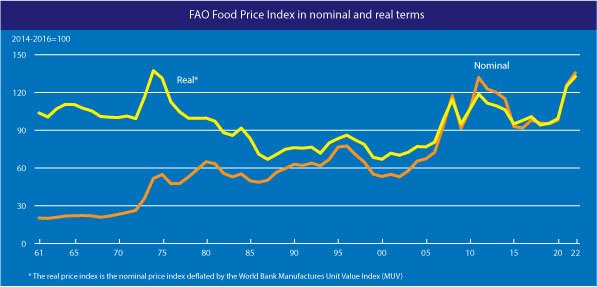

The FAO’s Food Price Index in January was near its 2011 peak (in nominal terms) and one step below its 1974 peak – a time of stagflation and the aftermath of the oil crisis. And the latest spike in grains prices suggests that these highs will already be surpassed in February.

It means that people will spend more on food and less on durable goods and services, worsening living standards.

Such price hikes are an additional headache for central banks around the world. They may find themselves forced to turn a blind eye to inflation so as not to put the economy and consumer demand under additional stress.

But this is terrible news for currencies. Forced inflation tolerance by the Central Bank will depreciate the value of money and suppress the exchange rate. This promises to be a problem for the euro and the British pound.

High inflation may no longer be a reason to buy the euro and the pound against the dollar on the forex market, as it would not increase the chances of a tightening of the central bank policy in the coming months. There could also be a reverse reaction when currencies come under pressure as investors sell off local bonds amid falling real yields.

The FxPro Analyst Team