False Bottom or Start of Something Big

March 27, 2020 @ 13:28 +03:00

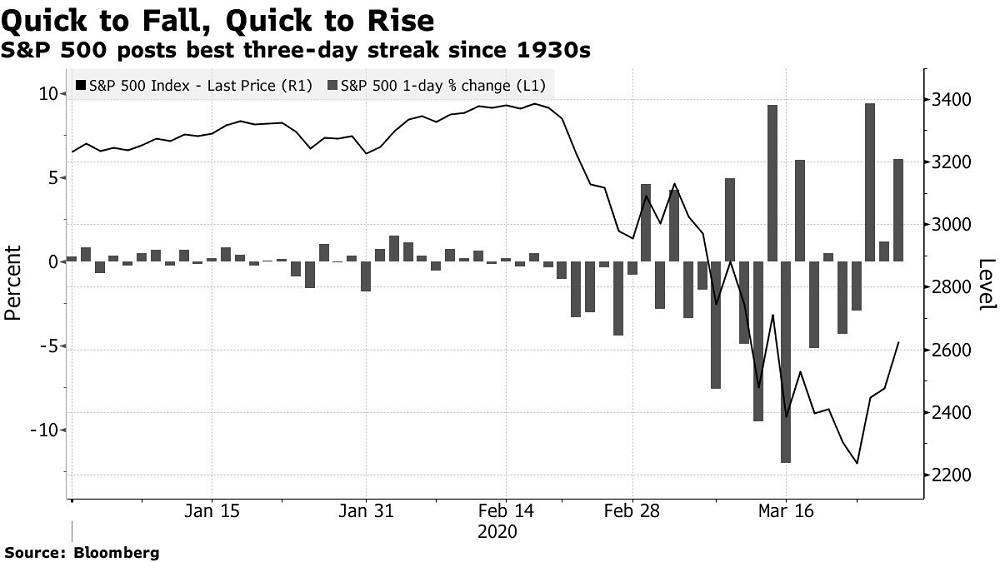

In the stock market lately, only one thing is constant: speed. After falling into a bear market at the fastest rate ever, the S&P 500 just recorded its quickest three-day advance in nine decades. As absurd as it may seem, the Dow’s already started a fresh bull market — up more than 20% from the lows — after more than $2 trillion in value was created in three days.

Is it a bear-market bounce or something more sustainable? Nobody could possibly know for sure. While stocks had surely priced in a huge amount of pain, nothing compares with the coronavirus in terms of shock to the economy. Using history as an imperfect guide, there’s reason to be skeptical — it’s taken stocks an average of 18 months to start to recover after first signs of an economic contraction. But with trillions of dollars of stimulus landing, the case for bottom feeding also exists.

It can’t be stated enough: no precedent exists for the current situation, in which a viral outbreak is killing thousands, has shut down economies and forced people to stay in their homes. This week, the amount of people filing for unemployment insurance more than quadrupled the previous record. In Washington, Congress is working on passing a historic stimulus package.

For every optimist who says we could be witnessing the start of something real, there’s a pessimist to remind you that the largest stock rallies happen in bear markets.

While reported jobless claims Thursday were worse than expected, many investors are hoping the increase will be temporary, says Chris Gaffney, president of world markets at TIAA. What’s important now is that Congress pass its $2 trillion spending bill to help shore up the U.S. economy. More negative economic data will likely challenge the market, but support is coming.

The expectation of fiscal support is already priced into markets, and going forward, there’s probably going to be a void of good news, according to Lauren Goodwin, economist and multi-asset portfolio strategist at New York Life Investments. Investors still need more clarity on the economic impact of the virus, the extent of credit risk, and assurance the market is functioning smoothly.

False Bottom or Start of Something Big: On This Rally’s Stamina, Bloomberg, Mar 27