Even BlackRock Hasn’t Got a Clue What’s Happening In Growth Stocks

July 22, 2020 @ 12:32 +03:00

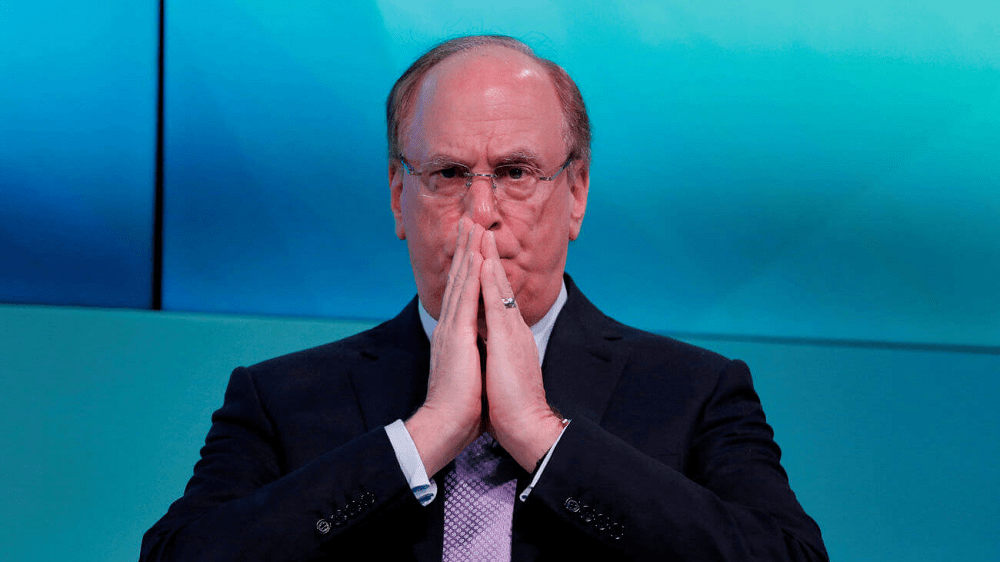

Blackrock, the largest asset manager in the world, may have just inadvertently provided the best justification yet to avoid investing in the stock market. One of its quant teams thinks you should stop caring about price entirely, and that’s terrifying.

As tech stocks go berserk against the backdrop of an unemployment crisis and global pandemic, it’s almost impossible for a rational investor to justify current pricing.

Here’s a portion of the ideology that the strategy Jeff Shen from BlackRock believes in: The market is looking at a billion of things that we only know a very small amount of. While the philosophical conversation is right in the sense that there should be some fundamentals relative to the price, how the market prices different fundamentals, different sentiment, different flows is pretty much a mystery to any one of us.

For those who don’t speak Wall Street sales, allow me to translate: he doesn’t have a clue what’s happening.

Shen’s strategy is boldly seeking the riskiest stocks because they offer the most significant upside. (It’s a lot easier to be bold when you’re not gambling your life savings.)

If that doesn’t scream dot-com bubble, I don’t know what does. If an asset-manager at a Federal Reserve partner institution, which holds $7.4 trillion in assets, can’t get a handle of what’s going on, then no-one can.

Except, that’s not entirely true. Cryptocurrency enthusiasts saw this exact storyline play out in 2017.

First, take a new and exciting asset with an incredible story and obvious potential. Now insert a populous existing in a world where asset prices are crushingly high, and life-changing investment returns are long gone.

Cue a retail-mania as they see early investors make mega-money. FOMO strikes with a vengeance, and everyone’s layman friends are calling to ask where they can buy bitcoin.

At peak euphoria, the most effective trading strategy was to go into Binance and simply purchase the cheapest altcoins. I don’t mean figuring out what the lowest valuations were relative to supply, technology, or purpose, I mean simply the cheapest token or coin you can buy.

That’s precisely what we see today in the stock market. If Amazon is bitcoin, Tesla may be Litecoin, and Nikola is Tron or XVG.

Over the last few weeks, financial professionals have been inundated with questions about how they can buy stocks. This is a speculative retail mania, nothing more and nothing less. We also have clear evidence the wolves are front-running the sheep.

BlackRock is wrong; there aren’t a million things this market is observing. It’s looking at one: prices.

Even BlackRock Hasn’t Got a Clue What’s Happening In Growth Stocks, CCN, Jul 22