EURUSD’s battle for the trend

August 24, 2023 @ 15:46 +03:00

There is an important battle for the long-term trend in the euro-dollar pair. The central bank speeches in Jackson Hole on Friday have enough potential to break or reinforce the direction of the past 11 months.

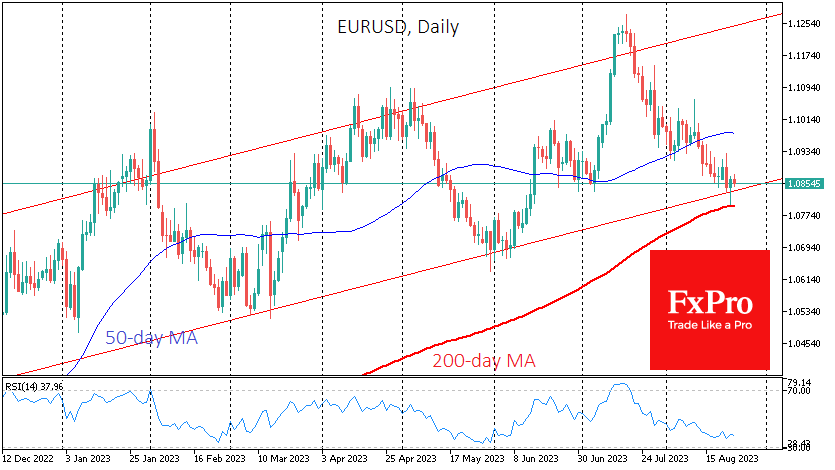

EURUSD is trading near the 1.0850 level during European trading following Wednesday’s notable moves. The single currency was hit by a sell-off following weak German services PMI data, dragging down the Eurozone Composite PMI.

In minutes, the single currency fell back to the psychologically important round 1.08 level. This is also where the 200-day moving average passes through. These technical factors have rekindled interest in the euro among sellers.

We should also not forget the positive correlation between the single currency and equity indices. The latter’s positive traction helped the EURUSD fully recover, although the move did not develop on Thursday.

The EURUSD is now clinging to the lower boundary of the bullish corridor of the past few months, from which it also reversed in March and early June.

Most likely, the bears haven’t had their last word yet, as the pair hasn’t reached the over-sold region on the daily RSI, even after five and a half weeks of declines, leaving the potential for further drop.

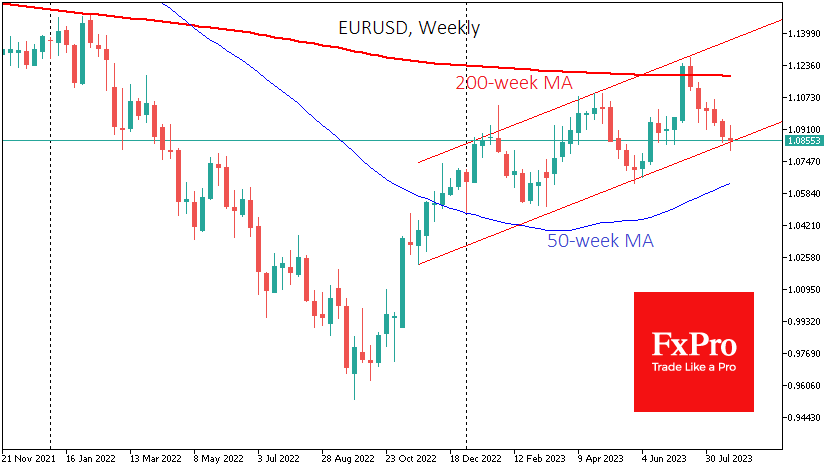

Technically, the bearish reversal followed a failed attempt to break above the 200-week average at 1.12. The single currency has been trading below this since November 2021.

The bears also have the 50-day moving average, which acts as a medium-term trend, on their side. Earlier this month, it turned from support to resistance, taking eight trading sessions. It is, therefore, not surprising that the tug-of-war is intensifying as we approach the long-term trend indicator, the 200-day.

So far, we are seeing more signals in favour of further declines in the pair. However, the most prudent tactic would be to wait for the EURUSD to make a decisive move away from the 200-day moving average. The direction of this breakout promises to be the most accurate indicator of where the pair is headed in the coming months.

If the bulls win, we could see the pair rally to 1.1050 within a few weeks and consolidate the uptrend for months.

A strong EURUSD move below 1.08 in the coming days would be a resounding defeat for the bears, opening a quick path to 1.0650 and the prospect of further weakening the pair to parity in the coming quarters.

The FxPro Analyst Team