EURUSD is too oversold

October 03, 2022 @ 13:32 +03:00

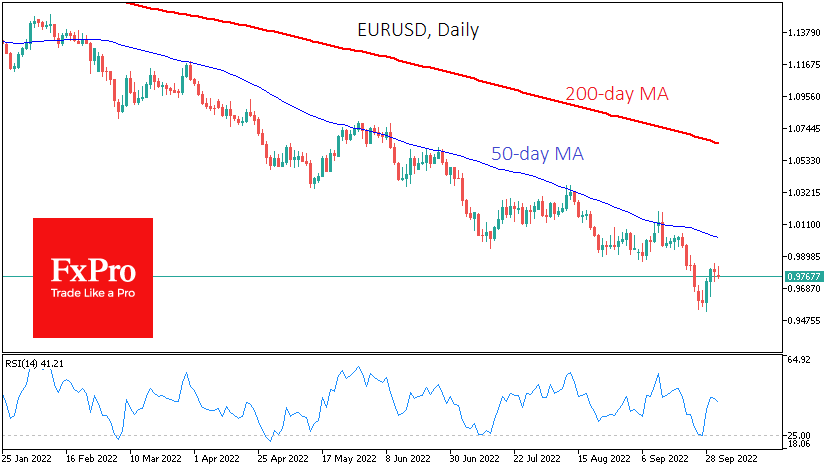

EURUSD, the world’s most liquid currency market pair, ended September down 2.5%, having consolidated below parity. A combination of technical and fundamental factors raises the chances of a rebound in the pair, potentially translating into long-term growth.

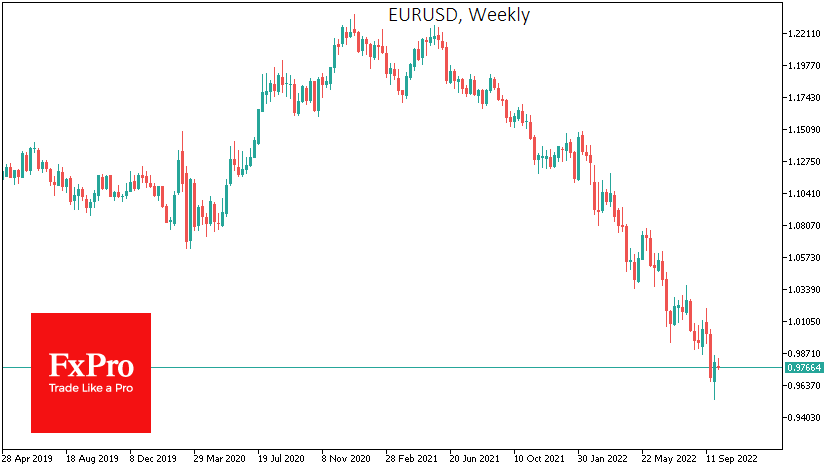

Last week ended on the bulls’ flag, which pushed the pair up by 3.2% to the week’s lows and allowed it to return to 0.9800 vs the lows of 0.9535 by the end.

Of the last 15 months, declines have been recorded on 12 occasions, indicating sustained bearish sentiment. However, the accumulated oversold conditions in the pair during this period show that ‘buying the dip’ has intensified.

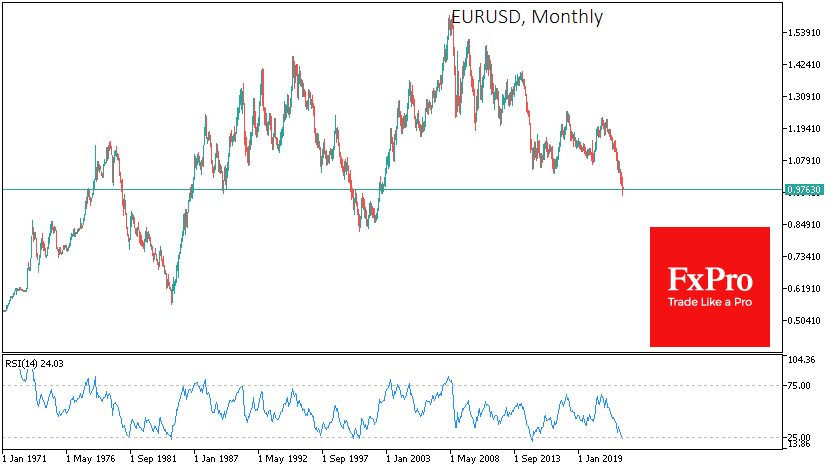

A large lower shadow on a monthly candlestick in the EURUSD after a prolonged downward trend might also be an early sign of a positive month ahead. There are plenty of such examples in the pair’s history.

But an even stronger signal is the oversold RSI on the monthly charts. This index closed the month below the 25 levels. In the history of the Euro (including the one that has been emulated since 1971 based on its components), the index has reached such low levels five times, and for the following month, the rate rose by 3.9% with a range of 0.8% to 8.2%.

However, we also point out that the reversal from decline to rise occurred only in 1985. In the other cases, the low RSI signalled a switch from downside to sideways (October 2000, 2015) or a significant shake-up of some months (1981, April 2000).

In addition, there are signs that fundamental factors are increasingly supporting the corrective rebound. Monetary tightening in the eurozone is gaining momentum, preparing the markets for a rate hike of 75 points for the second time.

While the Fed is likely to slow down with policy tightening in the coming months in response to slowing inflation and the economy, this is not expected from the ECB, which will work to reduce spreads between European and US debt securities. This change would help to shift the balance of power in favour of the single currency.

In our view, it would not be surprising if market speculators saw the current low quotations for the Euro as a good buying point with a view to a possible long-term reversal.

The FxPro Analyst Team