EURUSD gets set to go

April 02, 2024 @ 16:11 +03:00

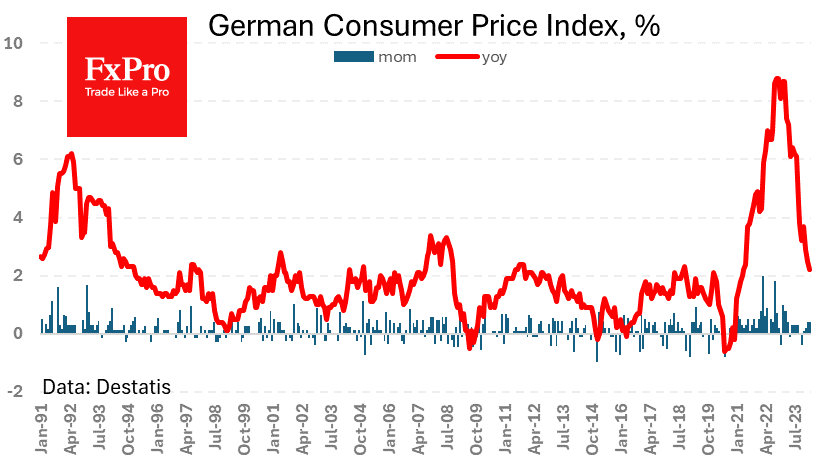

The slowdown in German inflation is fuelling hopes that the ECB will ease policy in the coming months. German CPI rose 0.4% m/m, weaker than the 0.5% expected. Annual inflation slowed from 2.5% in February to 2.2% in March, the lowest since May 2021.

Germany’s reading is a useful guide to what to expect in the eurozone on Wednesday, which is likely to come in weaker than average market expectations for headline inflation to slow from 2.6% to 2.5% and core inflation to slow from 3.1% to 3.0%. At the same time, it would take a significant deviation from the forecasts to have a material impact on prices.

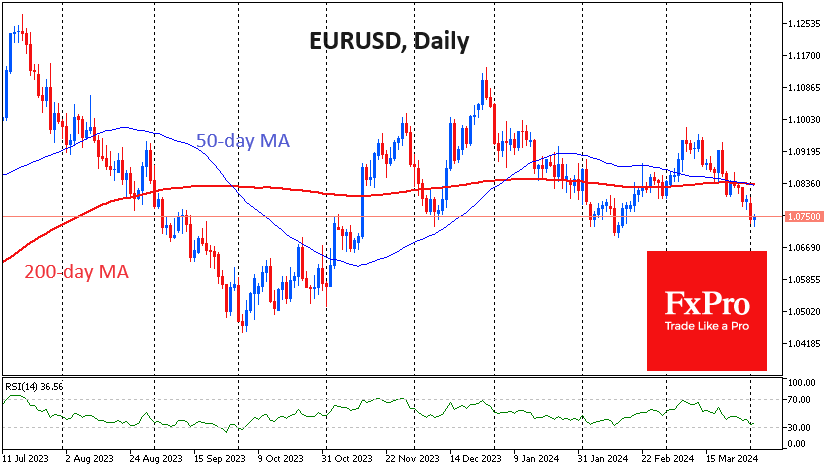

EURUSD slipped to 1.075, the lower boundary of the range since November. This is a good starting position for new momentum on a breakout or bounce. US data released on Monday was supportive of a strong dollar, while German inflation data was in favour of a weaker euro. If the balance of power remains the same, EURUSD may decide to move towards 1.05.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks