EURUSD correcting overbought, potentially aimed to 1.1300

March 10, 2020 @ 12:23 +03:00

Global markets are growing on Tuesday morning in anticipation of coordinated central bank stimulus measures and government attempts to stop panic sales in the markets. Today, markets are moving in the opposite direction to Monday’s dynamics, offsetting some of the losses (or gains) the day before.

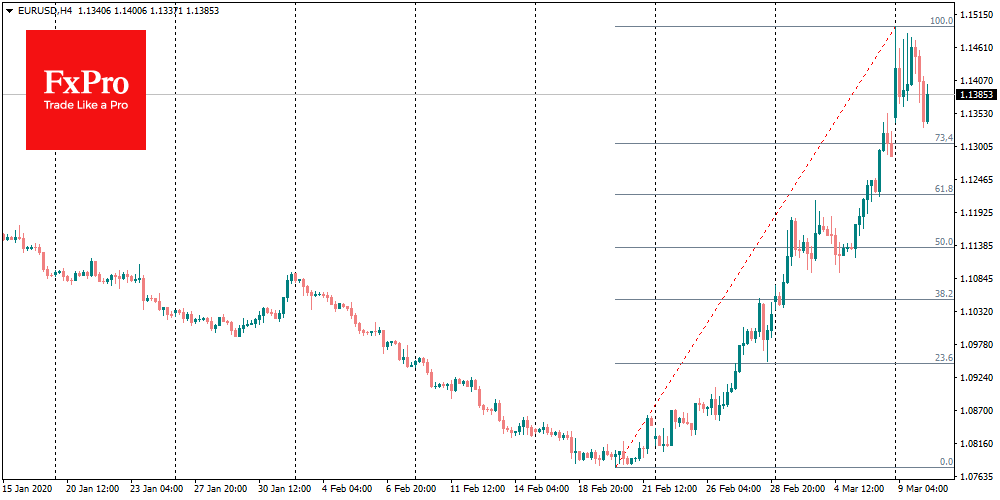

The EURUSD, which reached 1.1495 on Monday, slid back to 1.1360 before the start of trading in Europe. Since February 20, the pair jumped by 6.6%, which made it vulnerable rollback. There are also more fundamental reasons for this correction.

Europe was more affected by coronavirus than the United States, which can be seen both in the number of death and total cases of diseases, as well as in the impact of quarantine on the economy. At the same time, the weakening of the dollar against the euro was due that the Fed has more room to cut rates. Last Tuesday’s emergency rate cuts formed expectations that the US central bank may further soften the policy, which caused the growth of demand against the dollar. Also, the US data was weaker than expected in contrast to slightly more positive estimates in Eurozone.

However, with ECB meeting scheduled this week, it is worth to be prepared that it may announce more monetary easing. More measures may help to fight the consequences of the coronavirus quarantine and to reduce the pressure in financial markets.

As interest rates in the eurozone are already in negative territory, it would be more logical to expect the expansion of the QE program. These measures are not as painful for the suffering banking industry as more negative rates.

The technical analysis suggests that the development of the corrective rollback in the EURUSD may send it to the area of 1.1300. This move potentially may offset the overbought and taking the pair to the level of 61.8% of the rally, according to the Fibonacci theory.

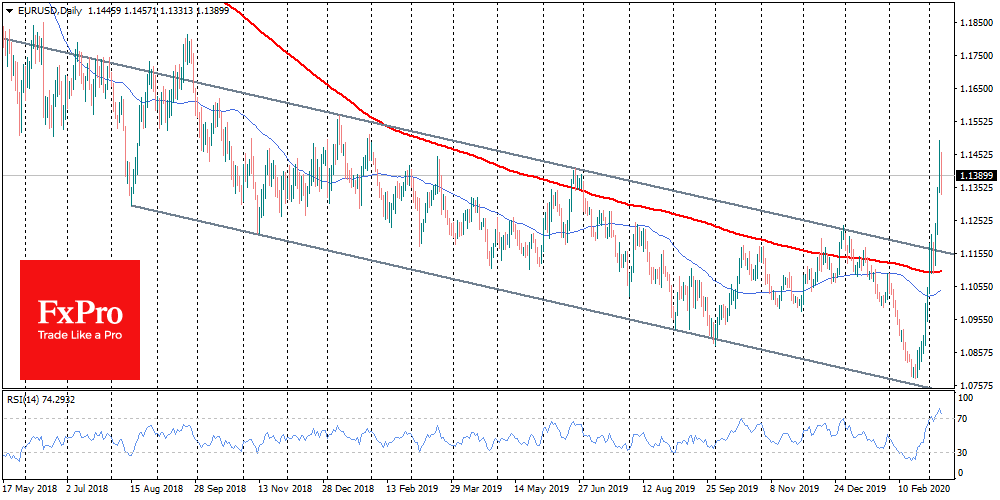

In the longer term, we believe it is more likely that the downtrend of the dollar will develop due to the expected easing of the Fed’s policy and lower demand for the US government bonds, the yields of which have fallen sharply in recent weeks, reducing their attractiveness compared to the European ones.

Besides, the “Trump effect”, which methodically urges the Fed to cut rates to levels lower than in Europe, should not be written off entirely. Although the US president has no direct influence on the Fed, he still choose Fed governor candidates, gradually forming a “right” team.

The FxPro Analyst Team