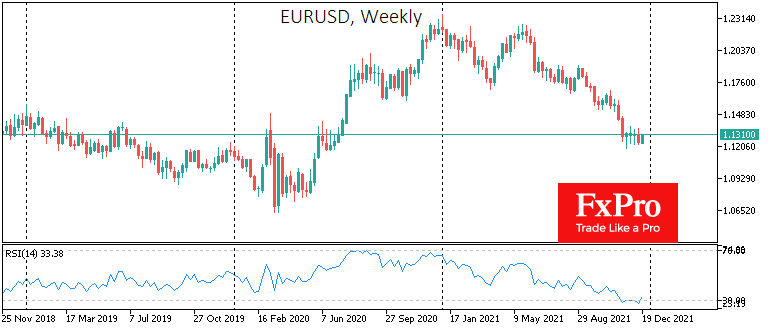

EURUSD consolidates before further decline

December 22, 2021 @ 18:01 +03:00

The main currency market pair, EURUSD, is trading in a sideways pattern of around 100 pips, rarely breaking out of it for long. The observed balance is very fragile. The news backdrop from Europe and the US has been very mixed regarding monetary policy and overall demand for risky assets.

When we look at the situation from a short-term perspective, the fundamental analysis is clearly against the Euro for now. Officially, the ECB has not backed down from its position that inflation is temporary, in stark contrast to the reversal of rhetoric and the acceleration of tapering from the Fed. From this perspective, the Eurozone’s lag in the rate hike cycle has so far only increased, which should reduce interest in the region’s bonds and put pressure on the Euro.

It seems that on the Euro’s side now is profit-taking from short sells after it has weakened by 8% and 6.5% against the Dollar and the Pound so far this year.

Also supporting the single currency could be the expectation that monetary tightening in the US, Britain, and a host of emerging economies will keep inflationary pressures in check, allowing the ECB to do its bit.

However, it is more likely that the current lull in EURUSD is only a temporary balance of power, which will be broken at the start of the new year as big players return to the market with ideas for new trades.

The pause in the EURUSD decline observed in recent weeks is not a sign of ironclad support in the Euro at current levels. Instead, it is a local retracement of positions. And, after a pause, EURUSD will head further down to the multi-year lows at 1.05-1.07.

The FxPro Analyst Team