European and US stock markets shake off war

March 30, 2022 @ 11:23 +03:00

The Russia-Ukraine peace talks have revived momentum in risk-sensitive assets.

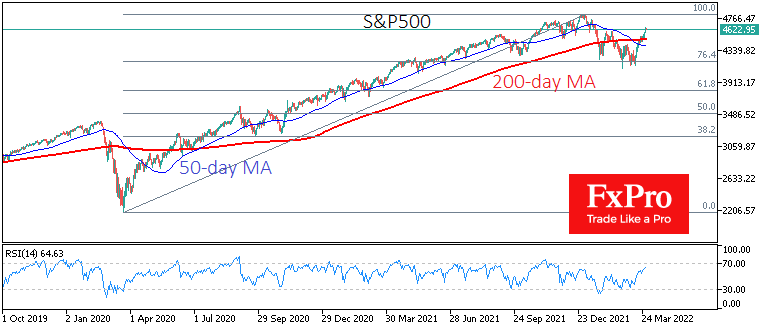

The market reaction to the outcome of the peace negotiations brought the indices back to where they had last been before the last days of February. The S&P500 reached its highest levels in two and a half months.

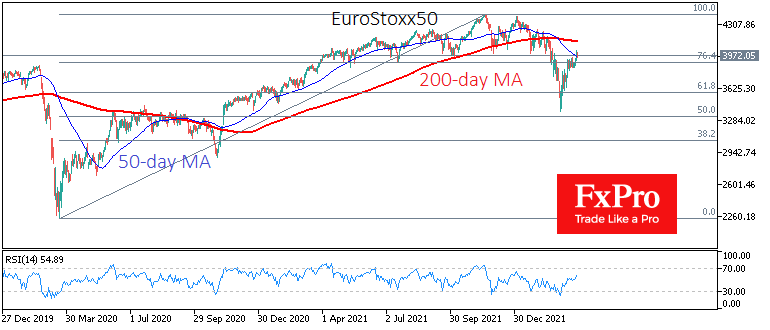

European indices had bottomed as early as the 7th of March. Still, this recovery momentum stalled about a week ago, with the Euro50, FTSE100 and DAX all approaching levels where they were at the end of February, during the early days of the military conflict.

The military conflict is far from over, and businesses have been badly affected by the sanctions and jump in commodities and energy. In addition, the turnaround in the indices took place well before the progress of the negotiations. Both these theses led us to look for other reasons behind the current share rally.

In our opinion, the answer is to be found in monetary and fiscal policy. The uncertainty in Europe and the blow to the global economy looks like an important reason for the Fed to tone down its rhetoric last month and, as a result, raise the rate by 25 points rather than the 50 that we were prepared for in January.

Monetary policy is still aimed at normalisation, but the authorities act more cautiously than required by the conditions of even higher inflationary pressures than estimated in January.

Fiscal policy is considerably softer: Europe is discussing new stimulus and the next issue of EU joint bond; the USA is increasing defence spending and domestic programmes at new records.

The remaining highly soft monetary policy and supportive fiscal policy create the conditions for further strengthening of the US and European stock markets.

China is also contributing its support. The People’s Bank of China continues to inject liquidity into the financial system, supporting the pull into risky assets. Chinese indices have recovered much of March’s slump, adding 11% from the bottom in the China A50, 23% in the Hang Seng and 26% in the H-shar.

It is also worth noting that stock markets are far from the overheated area, which leaves room for further upside moves in the coming days.

The FxPro Analyst Team